According to the Department of Business and Professional Regulation (DBPR), the state received 9,831 contractor-related complaints during the 2022–2023 fiscal year. Of those, 4,699 were found legally sufficient, 1,007 resulted in formal administrative complaints, and 773 led to final disciplinary orders. That’s a clear sign that contractor-related issues, including property damage, are more common than most homeowners realize. At RRBH Law, we’ve helped many Florida homeowners hold negligent contractors accountable. This blog will walk you through what to do if a contractor damages your property, based on real-world experience and Florida law. If you’ve been searching for a property damage lawyer or “property damage attorney near me,” this guide is your first step toward resolution. What to Do if a Contractor Damages Your Property Document the Damage Immediately Before you talk to anyone or touch anything—take photos. Start by snapping pictures and videos of the damage from every angle. This helps show exactly what happened and when. Make sure to capture: Wide shots of the entire room or area Close-ups of any cracks, stains, broken items, or debris Video walkthroughs if helpful Any tools or materials left behind that may have caused the damage Keep the original files and back …

What Is Hazard Insurance for Homeowners and What Does It Cover?

As a homeowner, one of your biggest priorities is making sure your property is protected. But with so many insurance options, it can be tough to figure out exactly what you need. It’s an important part of your homeowner’s insurance and can really help when disaster strikes. In 2023, the National Oceanic and Atmospheric Administration (NOAA) reported weather-related disasters caused a staggering $93 billion in damages across the U.S. From wildfires to storms, these events are unpredictable and happen more often than we’d like. So, what is hazard insurance for home going to protect you against? It’s the coverage that helps you recover if your home is damaged by things like fire, severe storms, or even sinkholes. But what exactly does it cover, and how does it work? What Is Hazard Insurance for Home? It is a type of coverage that protects homeowners from damage caused by a variety of natural disasters and events. Essentially, it’s the insurance that covers your home from physical damage brought about by things like fires, severe storms, hail, snow, and even sinkholes. As long as the event is covered under your specific policy, hazard insurance can help cover the costs of repairing or replacing …

What Is Actual Cash Value vs. Replacement Cost in Property Insurance?

“Insurance is not meant to profit the insured; it is meant to restore them.” This widely recognized principle raises a vital question for property owners: How much will your insurance actually pay to restore your property after a loss? The answer often hinges on whether your policy is based on actual cash value vs replacement cost (ACV vs. RCV)—a distinction that can significantly impact your recovery. According to the Insurance Information Institute, most homeowners misunderstand the distinctions between these terms until it’s too late—when they file a claim. Knowing the difference can significantly impact your ability to recover after property damage. What Is Actual Cash Value vs. Replacement Cost in Property Insurance? ACV Meaning in Property Insurance Actual Cash Value reflects the current market value of your damaged property, considering depreciation. Depreciation accounts for the item’s wear and tear, age, and use. For example, if a ten-year-old roof sustains damage in a hurricane, an ACV insurer will calculate the payout based on what the roof is worth today—not what it costs to replace. If the roof cost $20,000 to install but is now worth $8,000 due to age and wear, your payout will be based on $8,000. You’ll likely need …

What are the Premises Liability Risks for Slippery Floors and Other Hazards in Florida?

Florida is known for its beautiful beaches, vibrant cities, and year-round sunshine, making it a popular destination for residents and tourists. However, with the state’s bustling public spaces and numerous businesses, the risk of accidents, particularly slip and fall incidents, is ever-present. Slippery floors and other hazards can lead to serious injuries, which may result in premises liability claims. Understanding the risks associated with such accidents and the legal framework governing premises liability in Florida is crucial for both property owners and visitors. What is the Statute of Limitations for Premises Liability in Florida? In Florida, property owners must maintain safe environments for all visitors. This duty is outlined in general negligence principles and Florida Statute § 768.0755, which covers slip and fall cases. To hold a property owner liable, the injured party must prove the owner knew or should have known about a hazardous condition and failed to address it. Constructive knowledge can be shown if the hazard existed long enough for the owner to notice and correct it or if the condition occurred regularly and was predictable. For instance, if a store doesn’t promptly clean a spill and someone slips, the store could be liable if it proves …

Property Insurance Claims: How to Ensure Fair Compensation

Experiencing property damage is undoubtedly a stressful situation. In such challenging times, your insurance policy becomes a lifeline, providing a sense of security and the promise of financial support. However, the process of filing and negotiating property insurance claims can be intricate, often leaving policyholders confused and frustrated. This blog aims to empower you with knowledge on navigating this process to ensure fair compensation. Understanding Your Policy: Your First Step to Fair Compensation for Your Property Insurance Claims Interpreting Coverage Terms When you invest in a homeowner’s insurance policy, it’s crucial to grasp the coverage it provides. Typically, these policies cover damages caused by fire, lightning strikes, and certain natural disasters. However, it’s important to note that some perils, like floods and earthquakes, may require separate coverage. Additionally, your policy may extend coverage to personal belongings, such as jewelry and collectibles, and offer options for additional coverage on trees, shrubs, and detached structures like garages. Suppose your mortgage provider purchases the policy on your behalf. In that case, it’s essential to review and understand the coverage to avoid any surprises during the claims process. Knowing exactly what is covered provides a strong foundation for negotiating fair settlements with insurance claims …

Hiring A Property Insurance Attorney – The Cost Of A Professional

What is a Property Insurance Claim? A property insurance claim is a request for payment from an insurance company for damages to property, such as a home or business. The insurance company will investigate the claim and may pay for the repairs or replacement of the damaged property. If you have been the victim of a natural disaster, such as a fire, flood, or hurricane, you may need to file a property insurance claim. Many homeowners and business owners are not familiar with the process of filing an insurance claim, and hiring an attorney to help with your claim can be very beneficial. An experienced property insurance attorney will know how to navigate the claims process and get you the maximum compensation possible. They will also be familiar with the common pitfalls that can delay or deny your claim. The cost of hiring a property insurance attorney varies depending on the scope of work involved and the attorney’s fees. (video transcription) “We work on a contingency basis. So we’re contingent upon us being able to recover for the homeowners. So if we’re not able to recover for homeowners, the homeowners don’t pay us anything, and what’s good about working on …

What Types Of Property Damage Should Floridians Know About?

Have you ever wondered what types of property damage should Floridians know about? You may have considered hurricane or tornado damage, but did you know there are other ways your home could be damaged? Read on to learn about some of the most common property damages and how to prepare for them. What Types of Property Damage Are Most Likely in Florida? In Florida, property damage can include anything from broken windows to structural damage. Knowing what to look for in a property damage claim can help you get the compensation you deserve. Here are some common types of property damage in Florida: Wind and Hail Damage Florida’s weather is hazardous and accounts for a large number of insurance claims. Hail and wind damage are the most frequent types of weather-related insurance claims. The leading causes of wind and hail damage to property in Florida are windstorms, hailstorms, tornadoes, and hurricanes. To cover wind and hail damage, one may occasionally need to acquire a different policy, so be sure you know what your current policy covers. Water and Freezing Damage Florida homeowners may sometimes incur water damage from rain, flooding, plumbing defects, or melting ice – as well as from …

Does Renters Insurance Cover Water Damage?

If you’ve ever been without renters insurance and then experienced a flood, hurricane, or other natural disasters, you know that it can be a hassle to find out if your insurance will cover the cost of the damages. With so many multiple companies selling plans and so many other things, it might be difficult to keep track of the considerations that impact what is included in an insurance contract. This article answers the most common question: does renters insurance cover water damage? Does Renters Insurance Cover Water Damage? Renters insurance covers water damage in many scenarios but does not protect you in every situation. For example, incidents like a clogged toilet or a burst pipe are likely to be covered. However, most renter’s insurance policies do not cover damage caused by backed-up sewage or flooding or if the damage was caused by negligence (acting irrationally or recklessly). Furthermore, renters insurance only protects your personal property. Your landlord is responsible for the building’s regular maintenance, but renters insurance can help you protect your possessions. This means you don’t have to replace things like pipes if your plumbing fails; however, you may require insurance to replace damaged personal items. Water Damage From …

Condominium Insurance Dispute? Don’t Do It Alone

Condominium insurance disputes are sometimes complicated because of the fact that condominiums are in a community. Areas such as the stairs/elevator, administrative office, and parking lot are common to all condo owners. This is why condo owners are sometimes confused when it comes to insurance claims. At RRBH Law, we understand the rights of individual condo owners and the rights of homeowner’s associations. We believe that understanding and recognizing the rights of each is vital to achieving positive results for our clients in the event of a condo property damage accident. Making a Condominium Insurance Claim for Losses The way condo owners handle a loss is slightly different than the situation faced by people who own single-family homes. Condo owners have their own unique set of rules governing their insurance. The homeowner’s policy a condo owner owns only covers some property damage, others may be covered by the building owner or HOA. The following are the most common condominium insurance claims that both an individual owner and the HOA may raise: Damage caused by molds Damage caused by fire (smoke damage included) Damage caused by wind (including other damages that can necessitate windows and roofs to be repaired) Damage caused …

How Long Does a Home Insurance Claim Take in Florida?

How long does a home insurance claim take in Florida? When you file a homeowners insurance claim in the Sunshine State, you might expect immediate relief. Here’s why that’s a mistake. While it is practically impossible to pinpoint how long an insurance claim will take to pay out, there are a few milestones you can rely on to get an idea about what to expect. It can take days, weeks, or even months—sometimes even years—before you see a single cent from your insurance provider. It all depends on the circumstances surrounding your claim. Here are some things to keep in mind as you wait for the insurance company to cut you a check. How long does a home insurance claim take in Florida? In Florida, insurance companies have 90 days to notify you whether they have accepted or denied your claim. If your insurance provider approves your claim, the Florida Statues state that they must pay you within 20 days of their decision. If they do not pay your approved claim within this timeframe, the payout will accrue an interest rate of 12% per year. The larger the claim, the more likely your provider is to use the whole …

When Is Hurricane Season in Florida? Your 2022 Guide

When is hurricane season in Florida? Learn everything you need to know about it in this article. You have to deal with hurricanes and tropical storms when you live in Florida, especially in the coastal areas. Florida is plagued by hurricanes every year. The same holds true wherever you live in Florida, whether you live in Miami, the Florida panhandle, Jacksonville, southwest Florida, or anywhere else. However, do you know when hurricane season begins in Florida? Usually, the hurricane season in Florida starts around mid-summer and lasts until October. It is estimated that the Sunshine State will be most likely to be hit by a landfall hurricane in September. History of hurricanes and their frequency Hurricanes and severe weather have a long history in Florida. The state is frequently affected by extreme weather events. However, how frequent are they? According to Universal Property, there have been 120 hurricanes recorded in the form of Florida since 1851. What is the frequency of hurricanes in Florida? According to Best Places, tropical storms and hurricanes affect Florida approximately every three years. Therefore, it is essential to be aware of when hurricane season occurs each year if you live somewhere where it happens. …

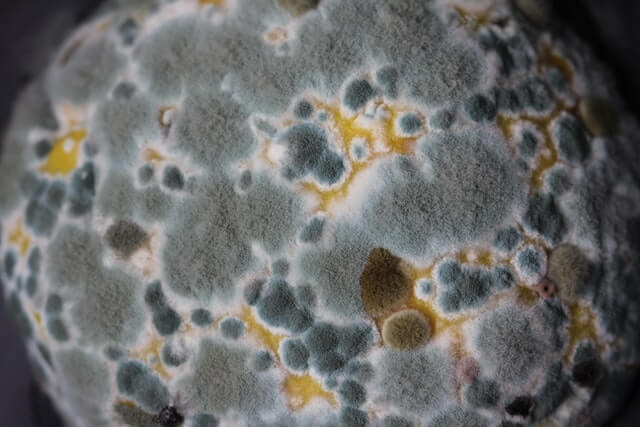

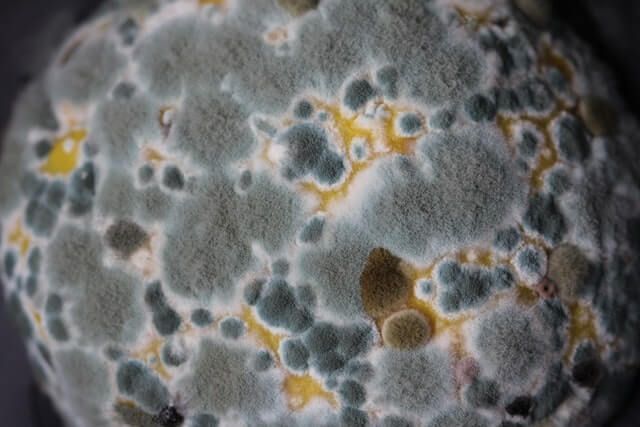

How Much Does Mold Remediation Cost?

When water, dirt, or other materials get into your home through a broken pipe or leaky roof and cause mold to grow, it can be frustrating. How much does mold remediation cost? Discover the main factors that can make the cost of mold remediation vary in this article! It might seem like a simple thing: just remove the mold from your house and go on with your day. However, there is much more to the mold remediation process than that. How much it costs and what you can do to prevent it are two critical questions that homeowners need to answer. We answer these questions in this article. How much does mold remediation cost? Mold remediation costs vary depending on factors such as the type of water damage, the severity and extent of the mold, and the amount of required cleanup. The average cost of mold remediation is about $2,300, though it often ranges between $1,300 and $3,300. High-cost jobs can cost as much as $6,000. There are many monetary costs associated with mold remediation, but the cost that is most important is the cost of living in a contaminated home or office. Molds and mildew can cause respiratory problems, …

Citizens Managed Repair Program: Do I Need a Florida Property Insurance Attorney?

Do you need a Florida property insurance lawyer? If you are a Citizens Property Insurance Corporation policyholder, you might. Here’s why you should consult a property insurance lawyer. Citizens Property Insurance Corporation is encouraging homeowners to use the Managed Repair Program intending remediation of non-weather-related property damage for less than what is required under Florida law. If you are a part of this program, it is essential that you consult an experienced Florida property insurance attorney who can help you understand your rights. Citizens Managed Repair Program: What You Should Know Citizens’ Managed Repair Program helps customers whose homes have been damaged by water. The program consists of two services: emergency water removal and a managed repair contractor network, both of which are available for customers with new and renewal homeowner (HO-3) and dwelling property (DP-3) policies only. Covered by Citizens, once water is removed and dried up for covered damages, contractors are on site to fix your home with a 5-year workmanship guarantee. According to Citizens, a policyholder may refuse or limit participation in the managed repair program. They advise, however, that it may impact the cost of the claim (excluding Emergency Water Removal Services). For example, if you …

Miami Property Insurance Claim FAQs: What to Expect After Filing

Property insurance claims are a hot topic these days. In this blog, you’ll find out how to answer some of the most common property insurance claim FAQs, including what to do if the insurance company underpaid your claim. As a homeowner, you know that your property insurance is there to help protect your investment and your family. However, you might be wondering if your insurance provider will raise your rates after a claim or two. Listed below are some questions and answers about property insurance to give you an idea of what to expect after a claim. With property insurance, nothing can truly be taken for granted. Even though homeowners may think they know what they’re doing when it comes to their coverage, it’s always important to keep up with changes in circumstances and remain vigilant of any potential changes to your policy. If you don’t know what to expect after filing a claim, these questions and answers may help. The insurance company underpaid my claim. What can I do? The amount of compensation you receive for your claim depends on a few different factors. Your coverage limits, the costs of repairs or replacement, and the extent of the damage …

Is It Safe to Stay in a House with Mold? Why You Should Limit Exposure

Is it safe to stay in a house with mold? While it might seem like mold is not a big deal, when it comes to your health, you shouldn’t write it off completely. Aside from the damage it can cause to your home; mold is also often hazardous if you are exposed to it for prolonged periods. In Florida, because of the high humidity levels and frequent hurricanes, mold is a common household problem, so most homeowners will have to deal with it at one point or another. If you are worried about the health effects of mold in your home, here are a few things to know. Is it safe to stay in a house with mold? Mold can cause reactions that range from mild to severe. Those who are more susceptible to the negative effects of mold exposure—such as people with respiratory conditions like asthma, mold allergies, and suppressed immune symptoms—are more likely to become seriously ill. Exposure over a few days may not be harmful, but staying in a home with active mold growth can cause symptoms. So, is it safe to stay in a house with mold? For many people, the answer is no. In general, …

Commercial Property Insurance in Florida: What to Know about Hurricane Coverage

Now more than ever, as businesses start to reopen, commercial property insurance in Florida needs to include hurricane coverage. Here’s what you should know about this essential coverage. Some businesses did not survive the pandemic. For those owners who made it through, a question—did you sacrifice to keep your doors open just to have to close after the next big hurricane? If you don’t have commercial hurricane coverage, that is likely to happen. Read on to learn more about what this type of coverage is for and who should have it. Commercial Property Insurance: Florida Excludes Some Damages One of the first things to understand about hurricane coverage is that it pays for many damages that are excluded from commercial insurance policies. Depending on your policy, your commercial property insurance might not cover some of the events that happen during a hurricane. For instance, many standard policies cover events such as fire, theft, vandalism, and windstorms. Hurricanes are typically excluded from standard policies. Building Owners and Renters Can Benefit Whether you own a commercial building or rent space for your business, you should consider adding hurricane coverage to your commercial property insurance in Florida. Not only does this coverage pay …

How to Prepare a Bad Faith Claim Against Your Homeowners Insurance

Has your homeowners insurance used bad faith tactics to avoid paying out your full settlement or deny your claim outright? You may have recourse through a lawsuit for a bad faith claim. This article offers a strategy. Do you believe your home insurer has failed to investigate your claim properly? Were you denied coverage without explanation? Have they delayed your settlement payment for an unreasonable amount of time? You may be able to file a bad faith claim against your insurer to get the compensation you deserve under your policy. Your insurance provider has a duty to deal with you in good faith. If you feel you are being treated unfairly, here are some steps you can take to increase your chances of winning your case. Preparing for a Bad Faith Claim Speak to Your Attorney From day one, you should be communicating with an attorney about your homeowners insurance claim. Your lawyer understands how the process can and should play out, so having them there to guide you can keep you from making avoidable mistakes that could jeopardize your claim. Document Everything If your claim is denied, you then need to start documenting everything you can. Get all the …

Why Mold Insurance Claims Get Denied

Words are important, especially in the legal industry. Homeowners insurance policies are often vague in their wording when it comes to mold coverage. Insurance providers sometimes deny mold insurance claims because of how a policy lays out what it covers—for the homeowners who receive a denial, that can mean they are out thousands of dollars. In a typical mold coverage case, the fate of the claim often hinges on one thing—whether the mold is a result of covered damage. Here’s what you need to know about mold insurance claims. When Does Homeowners Insurance Cover Mold? As mentioned above, in most homeowners insurance policies, mold removal is only covered when it is the result of a covered peril. Therefore, if a pipe bursts (or you experience other covered water damage) and the moisture causes mold to grow, you could file a claim for mold removal and the repair of anything permanently damaged by the mold, as well as any damage caused by the water. The primary stipulation to remember is this: if your homeowners insurance policy covers sudden, accidental water damage, you should be covered if any mold results from the water damage. Here are a few common examples of covered …

- Page 1 of 2

- 1

- 2