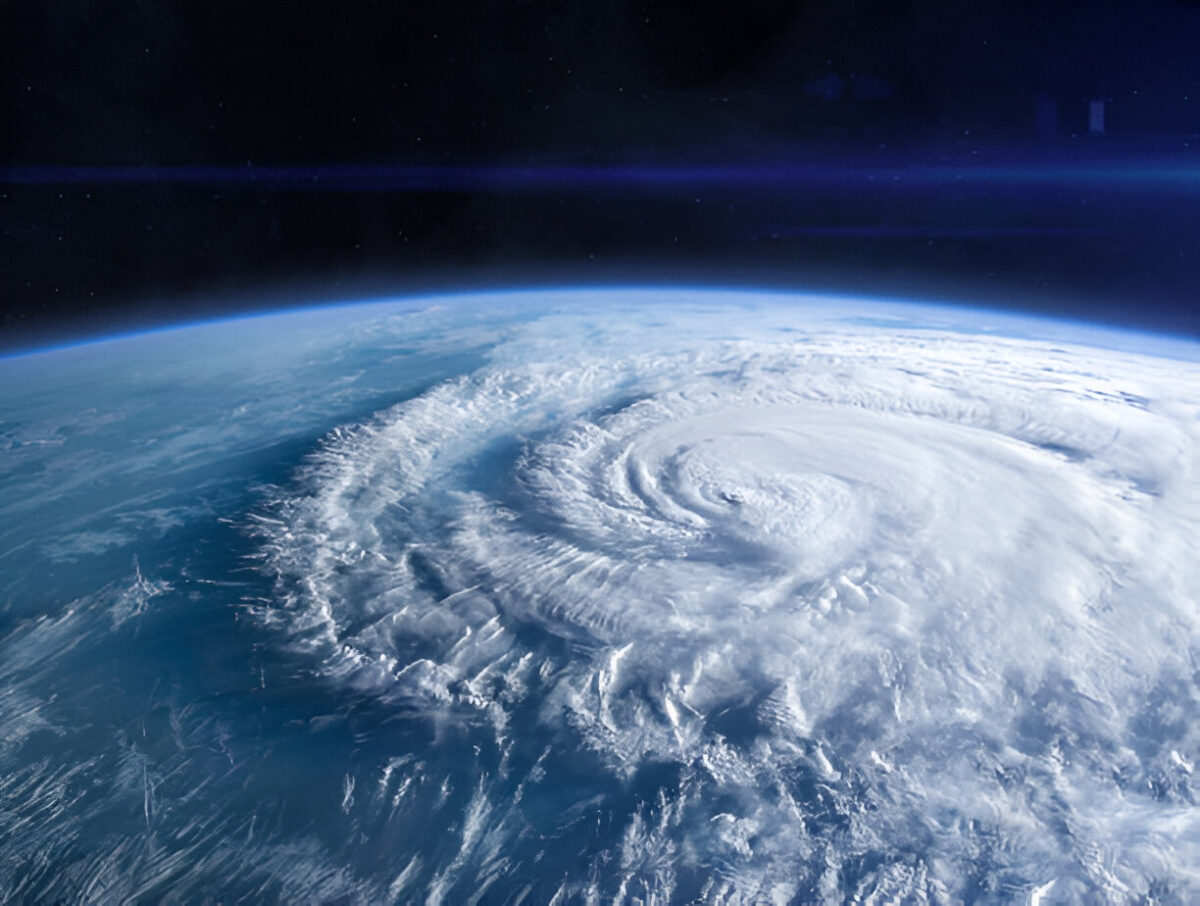

The 2024 hurricane season was one for the record books. It brought destruction, record-breaking storms, and some stark lessons about preparedness and climate trends. For Floridians, who are no strangers to hurricane threats, this season was a chilling reminder that vigilance, preparation, and understanding our changing environment are more important than ever. The 2024 hurricane season produced 18 named storms, 11 hurricanes, and 5 major hurricanes, exceeding the historical average. It was a season marked by destruction and resilience. But what can we learn from it to better prepare for the future? In this blog, we’ll dive into the most important takeaways, explore the factors that fueled the season’s intensity, and discuss why these lessons are crucial for every Floridian. How Many Hurricanes Struck Florida in 2024? The 2024 hurricane season was not only active but also destructive. Florida experienced multiple direct impacts, with two major hurricanes making landfall and causing significant damage. The state endured high winds, catastrophic flooding, and widespread power outages. Thousands of residents were displaced, and communities from the Panhandle to the Keys are still recovering. In total, the season produced: 18 named storms. 11 hurricanes. 5 major hurricanes (Category 3 or higher). These numbers are …

Does Homeowners Insurance Cover Plumbing?

Homeowners frequently encounter plumbing problems, which can be expensive to repair. As noted by the Insurance Information Institute, water damage makes up about 24% of all homeowner insurance claims annually. Many homeowners ask, “Does homeowners insurance cover plumbing?” Specifically, they wonder if their policy will cover plumbing damage from a burst pipe or accidental leak, which can lead to costly repairs reaching thousands of dollars. Finding the solution may be challenging, but correcting it could prevent significant financial strain. Knowing what your insurance includes in terms of plumbing is essential for preventing unforeseen costs. Let’s explore the specifics so you’re more equipped for any plumbing issues that may arise. When Does Homeowners Insurance Cover Plumbing? Accidental Leaks Unintentional spills from sources such as a malfunctioning water heater or damaged faucet can quickly lead to extensive destruction. If a sudden and unforeseen water leak occurs, your homeowners insurance will probably pay for the water damage and plumbing repairs. It is crucial to take prompt action, as delaying repairs can result in challenges when trying to get your claim authorized. Burst Pipes Experiencing a burst pipe is one of the most inconvenient plumbing problems a homeowner can face. Extensive damage may occur, …

Why Are Home Insurance Companies Leaving Florida?

Florida, known as the Sunshine State, is facing a pressing question: Why are home insurance companies leaving Florida? The state is already experiencing significant impacts from climate change, with floods and hurricanes causing extensive damage to homeowners. The aftermath of these natural disasters has profoundly affected Florida’s property insurance market, resulting in a surge of insolvencies and an alarming increase in claims payouts. As a consequence, home insurance companies are abandoning the state, leaving homeowners in a precarious position with skyrocketing premiums and limited coverage options. In this blog, we will explore the reasons behind this exodus and shed light on the potential solutions to the home insurance crisis in Florida. Why Are Home Insurance Companies Leaving Florida? The escalating climate crisis has been instrumental in driving home insurance companies away from Florida. The state witnessed the devastating impact of Hurricane Ian, which alone caused a staggering $65 billion in property damage. In 2022, property insurers had to pay over $100 billion in claims, a 50% increase from the average annual payouts of the previous decade. Consequently, fifteen property insurers faced insolvency in 2020, leaving a struggling market for the remaining companies. One of the primary drivers of this crisis …

How Much Does Mold Remediation Cost?

When water, dirt, or other materials get into your home through a broken pipe or leaky roof and cause mold to grow, it can be frustrating. How much does mold remediation cost? Discover the main factors that can make the cost of mold remediation vary in this article! It might seem like a simple thing: just remove the mold from your house and go on with your day. However, there is much more to the mold remediation process than that. How much it costs and what you can do to prevent it are two critical questions that homeowners need to answer. We answer these questions in this article. How much does mold remediation cost? Mold remediation costs vary depending on factors such as the type of water damage, the severity and extent of the mold, and the amount of required cleanup. The average cost of mold remediation is about $2,300, though it often ranges between $1,300 and $3,300. High-cost jobs can cost as much as $6,000. There are many monetary costs associated with mold remediation, but the cost that is most important is the cost of living in a contaminated home or office. Molds and mildew can cause respiratory problems, …

Hurricane Irma Update: Property Damage, Now What?

Hurricane Irma Update – Although Irma Arrived in Miami At High Tide, Most Claims We’re Seeing Involve Wind Damage Within days of slamming into the Caribbean and south Florida, Hurricane Irma pushed further north today, into areas to which many of our neighbors had evacuated over the weekend. The large rain bands extended across the entire state of Florida, downing trees and signs, pushing boats ashore and tearing off shingles. The storm’s arrival at high tide caused flash flooding, most of which fortunately receded by later today. Hurricane Irma Update On Damage: Although Irma’s damage to Florida was not as great as the worst forecasts, almost three quarters of the state are still without power, and areas such as Naples and Jacksonville, as well as low lying areas of Miami, suffered flooding, standing water and downed power lines. The Florida Keys suffered the brunt of the damage. Portions of the road were washed out, and the rest was strewn with debris including sections of boats, jet skis and even appliances. “I just hope everybody survived,” Governor Scott said after flying over the islands today. “It’s horrible what we saw.” Hurricane Irma Update On Insurance Claims: Many of our clients have been …

My Insurance Company Won’t Pay…Now What? How to Prepare for a Claim Denial

With the stormy season upon us here in Miami, the likelihood that you will need to file an insurance claim for damage caused by a hurricane or thunderstorm go up by the day. Insurance is supposed to give you peace of mind, and for that reason, any of your claims that get denied by the insurance company are all the more infuriating. It’s a common enough story. In the past 15 years, insurance companies have paid out more than $450 billion for damage done to property that is covered under their policies. Now that the numbers are in, those companies are trying to minimize their losses by looking for more ways to deny policyholders’ claims. Whether by finding legal loopholes or by simply rewriting policies to contain more claim exclusions, your insurance company has the advantage when it comes to winning a legal battle. What that means for policyholders is a repair bill that could lead to bankruptcy. Instead of being caught off guard when your insurance company refuses to repair your property after the next big storm, use these tips to get prepared: Document Your Property With today’s technology, it is so easy to document your property for insurance …