Can I sue my child’s school for an injury? If you live in Florida, you need to know how a lawsuit against a public entity like a public school works. Here’s what to know. You remember what it was like. Playing on the playground with your friends was fun. The gym class was a blast, especially dodgeball, right? Kids got to be kids. Now that you have kids yourself, though, would you feel comfortable letting them do the same kinds of activities you did? Maybe not. Children are resilient, but even they are not invincible. Even if your children are not involved in potentially dangerous extracurriculars, they can still get hurt. Freshly mopped floors without a caution sign in sight. Loose handrails on the stairs. The question is, can you hold the school accountable if your child is hurt because of their negligence? So, can I sue my child’s school for an injury? Yes, you can. Your child’s school has a duty of care, so if they acted negligently, you can pursue damages against them. One important detail, however, may change how your case proceeds—whether the school is a private entity or a public entity. If your child attends a …

How Long after a Slip and Fall Can You Sue in Florida?

The amount of time you have to file a lawsuit after you are injured in a fall varies by state. How long after a slip and fall can you sue in Florida? This article discusses the statute of limitations for personal injury lawsuits. According to 2014 data from the Florida Department of Health, falls are the leading cause of non-fatal injury hospital admissions as well as injury-related deaths in the state. Many falling injuries result in substantial medical bills and long periods of missed work, which can severely impact your ability to support yourself and your family. If you are hurt in a slip and fall accident, especially if you suspect another party’s negligence caused or contributed to your fall, it is in your best interest to explore your legal options for financial recovery. But you don’t have unlimited time to file a lawsuit, so you need to start the process sooner rather than later. In the Sunshine State, how long after a slip and fall can you sue? Florida’s Slip and Fall Statute of Limitations In Florida, the statute of limitations to file a lawsuit against a property owner for a slip and fall injury (and personal injury in …

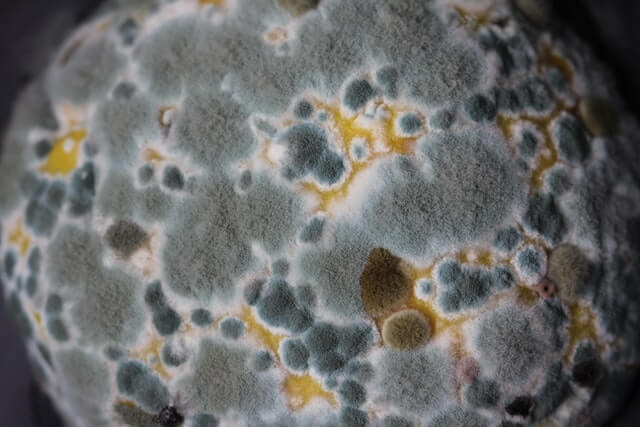

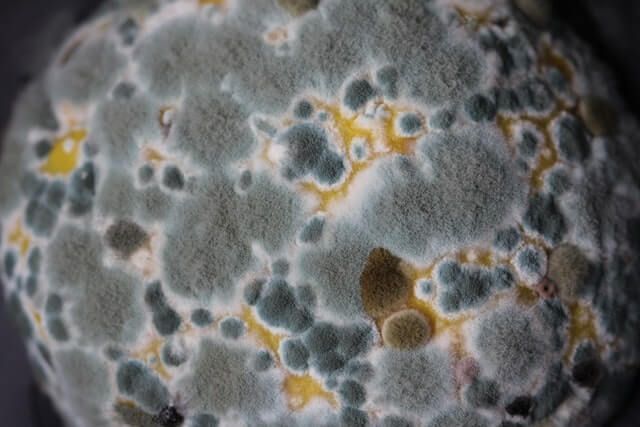

Is It Safe to Stay in a House with Mold? Why You Should Limit Exposure

Is it safe to stay in a house with mold? While it might seem like mold is not a big deal, when it comes to your health, you shouldn’t write it off completely. Aside from the damage it can cause to your home; mold is also often hazardous if you are exposed to it for prolonged periods. In Florida, because of the high humidity levels and frequent hurricanes, mold is a common household problem, so most homeowners will have to deal with it at one point or another. If you are worried about the health effects of mold in your home, here are a few things to know. Is it safe to stay in a house with mold? Mold can cause reactions that range from mild to severe. Those who are more susceptible to the negative effects of mold exposure—such as people with respiratory conditions like asthma, mold allergies, and suppressed immune symptoms—are more likely to become seriously ill. Exposure over a few days may not be harmful, but staying in a home with active mold growth can cause symptoms. So, is it safe to stay in a house with mold? For many people, the answer is no. In general, …

Commercial Property Insurance in Florida: What to Know about Hurricane Coverage

Now more than ever, as businesses start to reopen, commercial property insurance in Florida needs to include hurricane coverage. Here’s what you should know about this essential coverage. Some businesses did not survive the pandemic. For those owners who made it through, a question—did you sacrifice to keep your doors open just to have to close after the next big hurricane? If you don’t have commercial hurricane coverage, that is likely to happen. Read on to learn more about what this type of coverage is for and who should have it. Commercial Property Insurance: Florida Excludes Some Damages One of the first things to understand about hurricane coverage is that it pays for many damages that are excluded from commercial insurance policies. Depending on your policy, your commercial property insurance might not cover some of the events that happen during a hurricane. For instance, many standard policies cover events such as fire, theft, vandalism, and windstorms. Hurricanes are typically excluded from standard policies. Building Owners and Renters Can Benefit Whether you own a commercial building or rent space for your business, you should consider adding hurricane coverage to your commercial property insurance in Florida. Not only does this coverage pay …

Preventing Hurricane Injuries Is Possible When You Have the Facts

During a hurricane, injuries can happen to anyone—but if you are ill-prepared, you carry a bigger risk. This article discusses how you can prevent hurricane injuries during the next storm. It is not a matter of if but a matter of when the next big hurricane will hit South Florida. Here in Miami, we like to think that we are always prepared, but are we really? After all, anything can happen during a storm, and it can happen to anyone. You might think that it’s not possible to prevent an accident from happening—to an extent that is true. But you can drastically reduce your chances of getting hurt by taking a few simple actions before and during a hurricane. How to Prevent Hurricane Injuries during the Next Storm Put a Plan in Place Every family needs to have a plan in place before another hurricane hits. From planning your evacuation route to stocking up on essential supplies in case you need to shelter in place, preparing for several eventualities may help you avoid becoming frantic. When you are calm and know what to do in a stressful situation, you are less likely to hurt yourself. Power Down If you are …

The Most Dangerous Part of a Hurricane Can Leave Your Home in Ruin

Though high winds can cause significant damage to your home, they are not the most dangerous part of a hurricane. Learn about the dangers of storm surge and how to protect your property. During a hurricane, storm surge is the most dangerous threat to life and property. About half of lives lost during hurricanes are due to storm surge, and billions of dollars in property damage is possible from a single storm. To help you understand the risk of storm surge as we make our way into hurricane season, here are some facts about this hazard and what you can do to protect yourself. The Most Dangerous Part of a Hurricane: What Is Storm Surge? Storm surge refers to the abnormal rising water levels near the coast caused by high hurricane winds. Water is displaced onto coastal land, causing flooding in low-lying areas. When combined with rough ocean waves, storm surge can not only cause water damage and mold infestation to at-risk homes but also structural damage. During especially destructive storms, these factors can make your home uninhabitable. Steps to Take to Protect Your Home If your home is located in an at-risk area, it is critical to be ready …

How to Prepare a Bad Faith Claim Against Your Homeowners Insurance

Has your homeowners insurance used bad faith tactics to avoid paying out your full settlement or deny your claim outright? You may have recourse through a lawsuit for a bad faith claim. This article offers a strategy. Do you believe your home insurer has failed to investigate your claim properly? Were you denied coverage without explanation? Have they delayed your settlement payment for an unreasonable amount of time? You may be able to file a bad faith claim against your insurer to get the compensation you deserve under your policy. Your insurance provider has a duty to deal with you in good faith. If you feel you are being treated unfairly, here are some steps you can take to increase your chances of winning your case. Preparing for a Bad Faith Claim Speak to Your Attorney From day one, you should be communicating with an attorney about your homeowners insurance claim. Your lawyer understands how the process can and should play out, so having them there to guide you can keep you from making avoidable mistakes that could jeopardize your claim. Document Everything If your claim is denied, you then need to start documenting everything you can. Get all the …

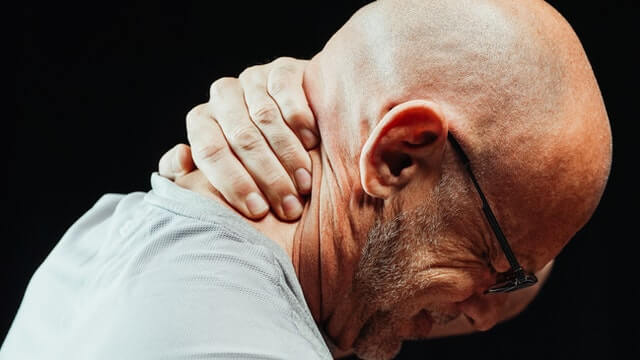

4 Types of Catastrophic Car Accident Injuries That Should Be Compensated

Catastrophic car accident injuries require serious medical attention. This article discusses a few situations in which you should seek compensation. Not all car accident injuries require the same amount of medical attention. Not all of them cause the same amount of pain and suffering, either. A catastrophic injury can change your life forever, leaving you with piles of medical bills and unable to work. On top of it all, your injury could leave you in constant pain and require years of rehabilitation to overcome—and that is often a best-case scenario. When your life is so irretrievably shattered, you deserve to be compensated. If you or a loved one suffer any of the following catastrophic injuries, you should speak to an attorney about what you need to do to get a fair settlement. Catastrophic Car Accident Injuries That Should Be Compensated Spinal Cord Injuries Spinal cord injuries can cause a wide range of issues, from diminished sensation to complete paralysis. Paraplegia and quadriplegia—the loss of function of the legs or all limbs respectively—can mean a life spent in a wheelchair. Aside from the lifelong cost of care following a spinal cord injury, there are also damages like loss of enjoyment and …

Do I Need Uninsured Motorist Coverage in Florida? 3 Reasons You Do

If you are wondering, “Do I need uninsured motorist coverage in Florida?” finding an answer might seem difficult. To make it easier, we provide three reasons you should have it below. As with any type of insurance, uninsured motorist coverage can help pay for your losses in the event of an accident. This particular type of coverage, however, can be essential if you are in an accident with a driver who is uninsured or whose coverage is inadequate to cover your injuries. In fact, we think it is one of the most important insurance decisions a person can make. Here’s why. What is UM coverage? Uninsured motorist insurance covers the injuries and damages that you and those covered under your policy sustain when involved in an accident with an uninsured or underinsured driver. It can cover things like your medical care, lost wages, and other losses you experience. Why You Need Uninsured Motorist Coverage in Florida Florida is a no-fault state. As a no-fault state, Florida requires drivers to use the coverage from their own policies before pursuing damages from the at-fault driver’s insurance. The minimum coverage for personal injury protection (PIP) that drivers are required to carry is $10,000 …

Need a Lawyer for Hurricane Insurance Claim? Only If You Want a Fair Settlement

Should you hire a lawyer for your hurricane insurance claim? It depends on your situation, but your settlement could benefit. Here’s how. This year is going to be another busy Atlantic Hurricane Season, according to the Colorado State University Tropical Meteorology Project. “We anticipate that the 2021 Atlantic basin hurricane season will have above-normal activity,” Dr. Phil Klotzbach, the leading scientist on the project, wrote in the 2021 report. If you have not already begun preparing your home and yourself for the possibility that your home could be damaged, you should begin doing so as soon as possible. You should also educate yourself about what to do following a hurricane. If you want a fair settlement, here are a few reasons you might need to hire an attorney. Benefits of Hiring a Lawyer for Hurricane Insurance Claim When you are considering whether to hire an attorney to handle your hurricane insurance claim, you might have a few questions. How will an attorney help me with my claim? Will it be worth it? Hurricane insurance claims can be time-consuming, complicated ordeals. Having a lawyer on your side can make the process easier and more streamlined. Here are a few things that …

Your Whiplash Injury Claim Amount Could Hinge on This

Interested in learning how to protect your whiplash injury claim amount? This article discusses one critical aspect you may not have considered. Thousands of car accidents happen every day, and a large portion of those accidents result in some sort of neck injury. Since they see them so frequently, insurance companies are all too familiar with whiplash injuries—and how to avoid paying out for them. You should do everything you can to keep your claim free of any mistakes that might help your insurance company deny your claim. And that includes one seemingly simple choice you make following an accident. The Doctor You Choose Could Make or Break Your Case When you visit a doctor for treatment after your accident, you should be careful to choose someone who is reputable and qualified to treat your injuries. While you may not have a choice about the doctor who treats you first if you are in need of emergency medical services, you can choose where you go once you are no longer in immediate danger. This choice could prove to be one of the most important in the insurance claim process. The size of your whiplash injury claim amount could be impacted …

Can I Sue My Insurance Company for a Better Settlement?

Can I sue my insurance company? Get the answers to your questions. Here’s what you need to know about suing your homeowners insurance company for a fair settlement. If you have ever filed a claim with your homeowners insurance provider and felt like you should have gotten more compensation when the check came, you are not alone. As profit-driven enterprises, insurance companies have gotten really good at paying out as little as possible for claims, even when they know that their offer is not even close to what it should be. So, the question is, can you do anything about it? Can you sue them for a fair settlement? The answer? Yes, You Can Sue Your Insurance Company In some cases, litigation is your only remedy when the insurance company does not hold up its end of the bargain. You may find yourself in many different situations where you need to file a lawsuit for your property damage claim. For instance, if you believe they are acting in bad faith, have wrongfully denied your claim, or are delaying your settlement, you may need to sue. When Can I Sue My Insurance Company? Just like people are expected to follow the …

Car Accident Lawsuit: Should I Sue for My Injuries?

Wondering whether you should file a car accident lawsuit for the injuries you sustained in a crash? This article offers some advice. When you are hurt in a car accident, your first thought should not have to be about whether you will be able to afford medical treatment. In some cases, however, you will need to file a lawsuit to recover fair compensation for your injuries and suffering. If you are trying to decide whether to file a car accident lawsuit to pay for your injuries, here are some of the things you should know. What Makes a “Good Case”? Put into simple terms, a good case for a car accident lawsuit is any case that involves significant injuries, but it really depends on your situation. The other driver’s insurance may adequately cover your expenses, in which case there would be no reason to seek further compensation. If, however, the other driver’s insurance coverage is inadequate, offers a low settlement, or denies your claim, you will need to take legal action to compensate you for the damages suffered. Damages can range from injuries and loss of income to pain and suffering. When to File a Car Accident Lawsuit If you …

Why Mold Insurance Claims Get Denied

Words are important, especially in the legal industry. Homeowners insurance policies are often vague in their wording when it comes to mold coverage. Insurance providers sometimes deny mold insurance claims because of how a policy lays out what it covers—for the homeowners who receive a denial, that can mean they are out thousands of dollars. In a typical mold coverage case, the fate of the claim often hinges on one thing—whether the mold is a result of covered damage. Here’s what you need to know about mold insurance claims. When Does Homeowners Insurance Cover Mold? As mentioned above, in most homeowners insurance policies, mold removal is only covered when it is the result of a covered peril. Therefore, if a pipe bursts (or you experience other covered water damage) and the moisture causes mold to grow, you could file a claim for mold removal and the repair of anything permanently damaged by the mold, as well as any damage caused by the water. The primary stipulation to remember is this: if your homeowners insurance policy covers sudden, accidental water damage, you should be covered if any mold results from the water damage. Here are a few common examples of covered …

10 Grocery Store Injuries That Could Entitle You to Compensation

The average person goes shopping at the grocery store about six times per month. With 72 trips to the store every year, it should be no surprise that grocery store injuries are a relatively common occurrence. Whether you shop for your family’s food at Publix, Walmart, or a local supermarket, you should know that if you get hurt in a grocery store that you could be entitled to compensation for your injuries. Here are 10 common grocery store injuries and accidents that could mean you need to file a lawsuit. Common Grocery Store Accidents Many of the grocery store accidents can be classified as slip and fall accidents. For example, if an employee mops a section of the floor but fails to put up proper signage and someone falls, that person could be entitled to compensation for their injuries. Here are some of the most common accidents that occur: Slip and fall accidents due to debris Slip and fall accidents due to spilled liquid or wet floors Improperly placed floor mats Falling items Uneven or damaged pavement on sidewalks or in the parking lot While there are many more kinds of accidents that may occur at a grocery store, these …

These 4 Steps Could Help You Get the Most from Your Hurricane Insurance Claim

No one knows when the next big hurricane is going to hit, so it is impossible to predict when you will need to file a hurricane insurance claim. Understanding the steps that you need to take after your home or property is damaged will not only help to speed along recovery time—it can also lead to a bigger claim check. Hurricane claims are some of the most stressful to file considering the devastation that can occur. Furthermore, your insurance company is likely to be overwhelmed by claims, which can slow recovery times. In many cases, the amount people receive from their insurance is less than they deserve, so when you know how to move forward, you are less likely to be taken advantage of by the insurance company. Many of the provisions included in a typical insurance policy are confusing, and it can be difficult to tell what your policy actually covers. To prepare for a worst-case scenario in which you have to file a hurricane insurance claim, you should review your insurance policy, if possible, with the help of an attorney. Which brings us to the first step you should take after a hurricane damages your property. Call Your …

Florida Hurricane Season 2020 Is Going to Be Busy, Possibly Destructive According to Experts

Every year, Florida residents must prepare their homes and families for the possibility of a hurricane making landfall in their area. According to weather and climate experts, Florida hurricane season 2020, which is expected to see more activity than previous years, might require more planning. Many of our clients come to us because they need help getting what they are owed from the insurance company after a major storm. Even after taking the proper precautions for securing and protecting their homes, many people still experience significant losses from hurricanes. When the insurance company refuses to pay policyholders for covered damage, negotiation and litigation are often necessary. Here is what you should know about this year’s hurricane season so that you can make adjustments to your insurance policy and get your home ready. The NOAA Predicted a Busy Hurricane Season On May 21, the National Oceanic and Atmospheric Administration (NOAA) published a news article titled, “Busy Atlantic Hurricane Season Predicted for 2020.” As the title suggests, the article details the scientific agency’s forecast for the frequency of major storms this year. According to the NOAA, 2020 is going to be very busy: NOAA’s Climate Prediction Center is forecasting a likely range …

Florida Personal Injury Attorney: 5 Tips for Preparing for a Deposition

When you and your Florida personal injury attorney file a lawsuit against the insurance company, both parties are permitted to collect evidence during what is known as the “discovery process.” Depositions are part of this process. What is a deposition and how can you prepare for yours? Here are five tips to help you get ready. What Is a Deposition? In the context of a personal injury lawsuit against an insurance company, a deposition is a pre-trial interview conducted under oath. During your deposition, your attorney and the attorney for the insurance company will ask you a series of questions. Your answers to these questions will form your testimony, which will be recorded. Review All Relevant Documents During your deposition, the attorney for the insurance company will ask you all kinds of questions about your case. The answers you give could influence how the court views your lawsuit, so it is best to be prepared. You can start preparing by reviewing documents like accident reports, medical records, notes or journal entries you wrote after your accident, and any other documents that could be relevant. Take Your Time with Each Answer Depositions are often high-stress situations, so when you start answering …