According to the Department of Business and Professional Regulation (DBPR), the state received 9,831 contractor-related complaints during the 2022–2023 fiscal year. Of those, 4,699 were found legally sufficient, 1,007 resulted in formal administrative complaints, and 773 led to final disciplinary orders. That’s a clear sign that contractor-related issues, including property damage, are more common than most homeowners realize. At RRBH Law, we’ve helped many Florida homeowners hold negligent contractors accountable. This blog will walk you through what to do if a contractor damages your property, based on real-world experience and Florida law. If you’ve been searching for a property damage lawyer or “property damage attorney near me,” this guide is your first step toward resolution. What to Do if a Contractor Damages Your Property Document the Damage Immediately Before you talk to anyone or touch anything—take photos. Start by snapping pictures and videos of the damage from every angle. This helps show exactly what happened and when. Make sure to capture: Wide shots of the entire room or area Close-ups of any cracks, stains, broken items, or debris Video walkthroughs if helpful Any tools or materials left behind that may have caused the damage Keep the original files and back …

What Is Hazard Insurance for Homeowners and What Does It Cover?

As a homeowner, one of your biggest priorities is making sure your property is protected. But with so many insurance options, it can be tough to figure out exactly what you need. It’s an important part of your homeowner’s insurance and can really help when disaster strikes. In 2023, the National Oceanic and Atmospheric Administration (NOAA) reported weather-related disasters caused a staggering $93 billion in damages across the U.S. From wildfires to storms, these events are unpredictable and happen more often than we’d like. So, what is hazard insurance for home going to protect you against? It’s the coverage that helps you recover if your home is damaged by things like fire, severe storms, or even sinkholes. But what exactly does it cover, and how does it work? What Is Hazard Insurance for Home? It is a type of coverage that protects homeowners from damage caused by a variety of natural disasters and events. Essentially, it’s the insurance that covers your home from physical damage brought about by things like fires, severe storms, hail, snow, and even sinkholes. As long as the event is covered under your specific policy, hazard insurance can help cover the costs of repairing or replacing …

What Is Actual Cash Value vs. Replacement Cost in Property Insurance?

“Insurance is not meant to profit the insured; it is meant to restore them.” This widely recognized principle raises a vital question for property owners: How much will your insurance actually pay to restore your property after a loss? The answer often hinges on whether your policy is based on actual cash value vs replacement cost (ACV vs. RCV)—a distinction that can significantly impact your recovery. According to the Insurance Information Institute, most homeowners misunderstand the distinctions between these terms until it’s too late—when they file a claim. Knowing the difference can significantly impact your ability to recover after property damage. What Is Actual Cash Value vs. Replacement Cost in Property Insurance? ACV Meaning in Property Insurance Actual Cash Value reflects the current market value of your damaged property, considering depreciation. Depreciation accounts for the item’s wear and tear, age, and use. For example, if a ten-year-old roof sustains damage in a hurricane, an ACV insurer will calculate the payout based on what the roof is worth today—not what it costs to replace. If the roof cost $20,000 to install but is now worth $8,000 due to age and wear, your payout will be based on $8,000. You’ll likely need …

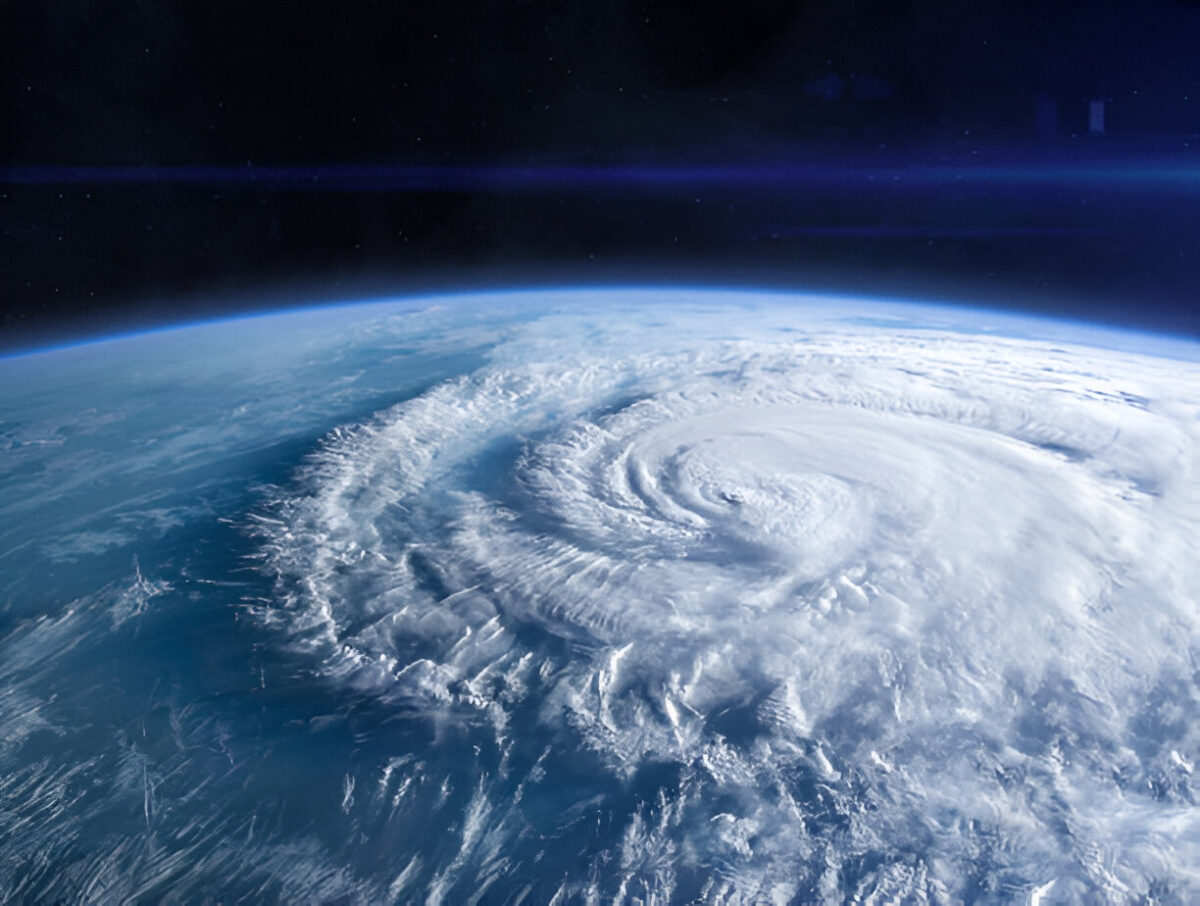

3 Crucial Lessons from the 2024 Hurricane Season Every Floridian Should Know

The 2024 hurricane season was one for the record books. It brought destruction, record-breaking storms, and some stark lessons about preparedness and climate trends. For Floridians, who are no strangers to hurricane threats, this season was a chilling reminder that vigilance, preparation, and understanding our changing environment are more important than ever. The 2024 hurricane season produced 18 named storms, 11 hurricanes, and 5 major hurricanes, exceeding the historical average. It was a season marked by destruction and resilience. But what can we learn from it to better prepare for the future? In this blog, we’ll dive into the most important takeaways, explore the factors that fueled the season’s intensity, and discuss why these lessons are crucial for every Floridian. How Many Hurricanes Struck Florida in 2024? The 2024 hurricane season was not only active but also destructive. Florida experienced multiple direct impacts, with two major hurricanes making landfall and causing significant damage. The state endured high winds, catastrophic flooding, and widespread power outages. Thousands of residents were displaced, and communities from the Panhandle to the Keys are still recovering. In total, the season produced: 18 named storms. 11 hurricanes. 5 major hurricanes (Category 3 or higher). These numbers are …

Do I Need Flood Insurance? Here’s Why It’s a Good Idea

Floods are the most common and costly natural disaster in the United States. According to FEMA, just an inch of water can cause over $25,000 in damage to a home. That’s not a statistic most homeowners consider—but it’s a reality many face. Florida is especially prone to flooding, with its low-lying coastal areas and heavy rains. The good news? Flood insurance can offer critical financial protection. Whether you’re a homeowner or a renter, this type of coverage can save you thousands in repair costs and provide peace of mind. So, do I need flood insurance? The answer may surprise you. What are the Financial Risks Associated with Flooding? Floods cause far-reaching and often devastating damage. When floodwaters invade a property, they can destroy floors, walls, electrical systems, and personal belongings. Repairing this damage is no small task. Without flood insurance, homeowners and renters have to bear these repair costs alone, which can quickly add up to tens of thousands of dollars. To see how much a flood might cost you, FEMA offers a Flood Cost Tool to give you a personalized estimate. For example, if your home has 1,000 square feet of space and experiences a six-inch flood, you could …

What is Subrogation and How Can It Affect Your Insurance Claim?

Did you know that your insurance company could have the right to go after a third party to recover the money they’ve paid out on your behalf? It’s called subrogation and could play a big role in your insurance claim. If you’ve ever filed a claim after an auto accident or a workplace injury, subrogation might already be working in the background without you knowing it. But what is subrogation? Understanding what it is and how it impacts your insurance claim is important. It’s one of those legal concepts that can directly affect the money you recover after an accident. In this blog post, we’ll walk you through exactly how subrogation works, the types of insurance policies it applies to, and why it matters to your final payout. What is Subrogation? Subrogation is when an insurance company can recover payment from the person at fault for an incident after covering your claim. If you’ve had an accident or injury, your insurance company may seek reimbursement for the damages they covered from the responsible party. Subrogation is a legal strategy insurance companies employ to shift the financial burden onto the party at fault rather than the blameless party or their insurance …

Does Homeowners Insurance Cover Plumbing?

Homeowners frequently encounter plumbing problems, which can be expensive to repair. As noted by the Insurance Information Institute, water damage makes up about 24% of all homeowner insurance claims annually. Many homeowners ask, “Does homeowners insurance cover plumbing?” Specifically, they wonder if their policy will cover plumbing damage from a burst pipe or accidental leak, which can lead to costly repairs reaching thousands of dollars. Finding the solution may be challenging, but correcting it could prevent significant financial strain. Knowing what your insurance includes in terms of plumbing is essential for preventing unforeseen costs. Let’s explore the specifics so you’re more equipped for any plumbing issues that may arise. When Does Homeowners Insurance Cover Plumbing? Accidental Leaks Unintentional spills from sources such as a malfunctioning water heater or damaged faucet can quickly lead to extensive destruction. If a sudden and unforeseen water leak occurs, your homeowners insurance will probably pay for the water damage and plumbing repairs. It is crucial to take prompt action, as delaying repairs can result in challenges when trying to get your claim authorized. Burst Pipes Experiencing a burst pipe is one of the most inconvenient plumbing problems a homeowner can face. Extensive damage may occur, …

Does Florida Insurance Cover Hail Damage?

Living in Florida exposes you to various weather risks, including hurricanes and thunderstorms, which can produce hail. One of the most common questions for homeowners here is, “Does Florida insurance cover hail damage?” Given the potential havoc a hailstorm can wreak on your property, especially the exterior of your home, understanding your insurance coverage is vital. How Long Does it Take to File a Hail Claim in Florida? Under Florida law, insurance policies are binding agreements between you and your insurance provider. In 2023, Florida encountered 23 reports of on-the-ground hail by trained spotters and has been under severe weather warnings 44 times in the past 12 months, affecting a range of properties from residential homes to commercial buildings. When filing a property damage claim, your policy serves as your roadmap, outlining the timeframe within which you must report damage to your insurer. Failing to do so within this window can result in your claim being denied. Upon reporting a claim under your homeowner’s insurance policy, the insurer must furnish you with a Homeowner’s Claims Bill of Rights within 14 days. This document outlines the timelines the insurer must adhere to during the claims process, ensuring transparency and accountability. Does …

Hurricane Preparedness Week: Are You Ready for the Next Florida Storm?

As Florida gears up for another hurricane season, the importance of Hurricane Preparedness Week, which runs from May 5-11, cannot be overstated. With memories of past storms like Hurricane Idalia and Hurricane Ian still fresh, this week serves as a crucial reminder of the need to be ready. These reminders underscore the critical importance of readiness, regardless of whether you reside inland or along the coastline. Hurricane Preparedness Is Critical for the Busy 2024 Season As the calendar inches closer to June 1st, marking the commencement of the 2024 Hurricane Season, the urgency for preparedness grows exponentially. The National Oceanic and Atmospheric Administration (NOAA) and the National Hurricane Center are issuing repeated warnings, underlining the gravity of the situation. National Hurricane Preparedness Week stands as a reminder, urging individuals and communities to take proactive measures to safeguard lives and property. Reflecting on the harsh lessons learned from past hurricanes, such as the unforgettable impacts of Hurricane Idalia and Hurricane Ian, the imperative for preparedness becomes abundantly clear. The devastation wrought by these storms left indelible scars—communities ravaged by storm surges, neighborhoods submerged in floodwaters, and landscapes scarred by relentless winds. The images of destruction serve as a stark reminder of …

Does Homeowners Insurance Cover Foundation Repair?

Homeownership comes with its joys and challenges, and foundation damage is one of the last things any homeowner wants to deal with. It’s not only a structural concern but also a financial headache. When faced with such a predicament, many homeowners wonder: Does homeowners insurance cover foundation repair? Let’s dive into the details to find out. Does Homeowners Insurance Cover Foundation Repair? The answer isn’t a simple yes or no. Whether your homeowner’s insurance covers foundation repair depends on various factors. If the cause of the foundation damage is listed as a covered peril under your policy, your insurer should foot the bill for repairs up to your coverage limits. However, deductibles may apply. It’s crucial to note that foundation damage resulting from normal wear and tear or lack of maintenance over time is typically excluded from coverage. Foundation damage and repair typically fall under the dwelling coverage portion of your insurance policy because it concerns the structure of your home. When is Foundation Damage Covered? Typically, homeowners insurance policies provide coverage for foundation damage categorized as “sudden and accidental” and caused by specific covered perils. These perils often encompass: Damage resulting from falling trees or other objects Incidents of …

4 Secret Tactics of an Insurance Claim Adjuster

When you file an insurance claim, you expect fair treatment and a swift resolution. However, navigating the complexities of insurance claims can be daunting, especially when faced with the tactics employed by insurance claim adjusters. These professionals are skilled in maximizing profits for their companies, often at the expense of claimants. In this blog, we’ll delve into the common insurance claim adjuster’s secret tactics and how you can protect yourself. What are an Insurance Claim Adjuster’s Secret Tactics? Building Trust to Minimize Payouts One primary tactic insurance claim adjusters use is building trust with claimants. They may present themselves as empathetic and understanding, aiming to establish rapport. While this may seem genuine, it often serves the purpose of minimizing payouts. By appearing friendly and cooperative, adjusters may persuade claimants to settle for less than they deserve. It’s essential to remember that adjusters represent the interests of the insurance company, not the claimant. To counter this tactic, maintain a level-headed approach and avoid divulging unnecessary information. Stick to the facts of your claim and refrain from discussing personal matters with the adjuster. Additionally, consider seeking guidance from a legal professional who can advocate for your rights and ensure fair treatment throughout …

Hurricane Idalia Update: 4 Takeaways from 2023

In the aftermath of the devastating Hurricane Idalia, which struck the Gulf Coast of the United States in 2023, communities grappled with the profound impacts left in its wake. As the dust settled and recovery efforts began, experts scrutinized the effects and lessons gleaned from this formidable storm. Here are four pivotal takeaways from the tumultuous passage of Hurricane Idalia. 4 Takeaways from Hurricane Idalia Storm surge was damaging Idalia’s landfall occurred in an area where natural barriers such as wetlands and forests typically offer some protection against storm surges. However, the storm’s powerful surge overwhelmed these defenses, flooding coastal towns across Taylor, Dixie, and Levy counties. Along the Steinhatchee River, water levels rose an astonishing 7 feet in just one hour, emphasizing the rapid and dangerous nature of the surge. Former NOAA scientist Jeff Masters highlighted the importance of timely evacuation, noting that waiting until the surge begins can be too late. Even areas like Tampa Bay, over 100 miles away from Idalia’s center, experienced significant surges, underscoring the region’s vulnerability. The devastating impact was evident in communities like St. Petersburg’s Shore Acres neighborhood, where nearly half the homes suffered damage from the inundation. Different causes led to deadly …

Property Insurance Claims: How to Ensure Fair Compensation

Experiencing property damage is undoubtedly a stressful situation. In such challenging times, your insurance policy becomes a lifeline, providing a sense of security and the promise of financial support. However, the process of filing and negotiating property insurance claims can be intricate, often leaving policyholders confused and frustrated. This blog aims to empower you with knowledge on navigating this process to ensure fair compensation. Understanding Your Policy: Your First Step to Fair Compensation for Your Property Insurance Claims Interpreting Coverage Terms When you invest in a homeowner’s insurance policy, it’s crucial to grasp the coverage it provides. Typically, these policies cover damages caused by fire, lightning strikes, and certain natural disasters. However, it’s important to note that some perils, like floods and earthquakes, may require separate coverage. Additionally, your policy may extend coverage to personal belongings, such as jewelry and collectibles, and offer options for additional coverage on trees, shrubs, and detached structures like garages. Suppose your mortgage provider purchases the policy on your behalf. In that case, it’s essential to review and understand the coverage to avoid any surprises during the claims process. Knowing exactly what is covered provides a strong foundation for negotiating fair settlements with insurance claims …

4 Florida Home Insurance New Year’s Resolutions

As we bid farewell to 2023 and welcome the promising horizon of 2024, it’s an opportune time to reflect on our accomplishments and set resolutions for the year ahead. While health, career, and personal growth often dominate New Year’s resolutions, it’s equally essential to consider the security and protection of our homes. In the Sunshine State, where the unpredictable nature of weather can pose challenges, ensuring your home insurance is up to date is a proactive step towards safeguarding your investment. In this blog post, we present four Florida Home Insurance New Year’s Resolutions for 2024. 4 Florida Home Insurance New Year’s Resolutions for 2024 Update Your Home Inventory In the aftermath of a storm, burglary, or any unforeseen disaster, a comprehensive home inventory becomes your ally. It not only streamlines the claims process but also ensures a fair and prompt settlement with your insurance provider. Creating a home inventory may seem daunting, but the sooner you get started, the sooner you can protect yourself in the event of a disaster. For those who already have a home inventory, allocate some time in January or February to update it. Include details of significant purchases made throughout the past year, paying …

What Caused the Florida Home Insurance Crisis?

The picturesque beaches, vibrant cities, and sunny climate make Florida an appealing place to call home. However, beneath the surface of this paradise, a storm is brewing – a storm not of nature’s making, but one born out of a complex interplay of factors. The Florida Home Insurance Crisis has become a topic of concern, with homeowners grappling with skyrocketing premiums and insurance companies facing unprecedented challenges. In this blog post, we delve into the suggested causes of this crisis, ranging from the impacts of climate change to the controversial role of frivolous lawsuits and the issue of improperly denied or underpaid claims. Suggested Causes of the Florida Home Insurance Crisis Climate Change The undeniable influence of climate change has cast a long shadow over the insurance landscape in Florida. While the state’s insurance issues extend beyond floods and storms, the intensification of these natural disasters exacerbates an already challenging situation. Sea levels have risen, rendering coastal flooding more frequent and severe. The ominous specter of rain bombs, like the one that crippled Fort Lauderdale, looms larger with the increasing prevalence of extreme rainfall. Moreover, the nexus between climate change, extreme heat, and drought conditions amplifies the likelihood of more …

Filing Hurricane Idalia Insurance Claim? What to Know

Hurricane Idalia struck Florida with devastating force, leaving a trail of destruction in its wake. The aftermath of this natural disaster has prompted thousands of residents to file insurance claims for their damaged properties and belongings. As of now, estimated insured losses have surged to a staggering $230 million, according to the Florida Office of Insurance Regulation. In this blog post, we will guide you through the essential steps and considerations for filing a Hurricane Idalia insurance claim, ensuring that you receive the compensation you deserve. What to Know About Filing a Hurricane Idalia Insurance Claim The aftermath of Hurricane Idalia has underscored the critical role that insurance plays in helping individuals and businesses rebuild their lives. However, the process of filing a hurricane insurance claim can be complex and challenging. Here’s what you need to know to navigate this process effectively: Report Your Claim ASAP The first and most crucial step is to report your insurance claim immediately. Depending on the nature of the damage to your property, your claim may be covered by wind insurance, flood insurance, or both. It’s essential to understand your policy coverage and ensure you report all relevant damages promptly. Homeowner’s insurance policies typically …

3 Things Homeowners Should Know About Flood Insurance in Florida

When it comes to securing your home against the unpredictable forces of nature, few places in the United States face the same level of risk as the Sunshine State. Indeed, the need for comprehensive flood insurance in Florida cannot be overstated. Owning a home in this beautiful state means embracing its unique challenges, and foremost among them is the constant threat of flooding. Florida is no stranger to heavy rains, hurricanes, and storm surges that can cause extensive damage to homes. In this blog, we will delve into three crucial things that homeowners in Florida should know about flood insurance. From the lack of seller disclosure requirements to the types of flood insurance available and the limitations of federal aid, understanding these key aspects can help you protect your investment and peace of mind. 3 Things to Know About Flood Insurance in Florida Sellers Aren’t Required to Disclose Flood Risk While Florida is notorious for its susceptibility to flooding, it’s surprising that state law does not mandate sellers to disclose flood risk or a property’s flood history to potential buyers. This lack of obligation places a significant responsibility on the shoulders of prospective homeowners. During your property inspection or walkthrough, …

Why Are Home Insurance Companies Leaving Florida?

Florida, known as the Sunshine State, is facing a pressing question: Why are home insurance companies leaving Florida? The state is already experiencing significant impacts from climate change, with floods and hurricanes causing extensive damage to homeowners. The aftermath of these natural disasters has profoundly affected Florida’s property insurance market, resulting in a surge of insolvencies and an alarming increase in claims payouts. As a consequence, home insurance companies are abandoning the state, leaving homeowners in a precarious position with skyrocketing premiums and limited coverage options. In this blog, we will explore the reasons behind this exodus and shed light on the potential solutions to the home insurance crisis in Florida. Why Are Home Insurance Companies Leaving Florida? The escalating climate crisis has been instrumental in driving home insurance companies away from Florida. The state witnessed the devastating impact of Hurricane Ian, which alone caused a staggering $65 billion in property damage. In 2022, property insurers had to pay over $100 billion in claims, a 50% increase from the average annual payouts of the previous decade. Consequently, fifteen property insurers faced insolvency in 2020, leaving a struggling market for the remaining companies. One of the primary drivers of this crisis …