If you’ve ever been without renters insurance and then experienced a flood, hurricane, or other natural disasters, you know that it can be a hassle to find out if your insurance will cover the cost of the damages. With so many multiple companies selling plans and so many other things, it might be difficult to keep track of the considerations that impact what is included in an insurance contract. This article answers the most common question: does renters insurance cover water damage? Does Renters Insurance Cover Water Damage? Renters insurance covers water damage in many scenarios but does not protect you in every situation. For example, incidents like a clogged toilet or a burst pipe are likely to be covered. However, most renter’s insurance policies do not cover damage caused by backed-up sewage or flooding or if the damage was caused by negligence (acting irrationally or recklessly). Furthermore, renters insurance only protects your personal property. Your landlord is responsible for the building’s regular maintenance, but renters insurance can help you protect your possessions. This means you don’t have to replace things like pipes if your plumbing fails; however, you may require insurance to replace damaged personal items. Water Damage From …

Does Home Insurance Cover Cast Iron Pipes?

One of the most common questions we receive from homeowners is: does home insurance cover cast iron pipes? Some things seem obvious to the point that it’s hard to believe many people don’t think about them. This is the case when it comes to insurance. While we all know your homeowners’ policy covers you if someone accidentally breaks your window, many homeowners probably don’t know if their home insurance will cover leaking pipes from broken cast iron pipes! Use this article to decide where other types of coverage might be necessary for your home and get yourself insured before tragedy strikes! What Are Cast Iron Pipes? Cast iron pipes are made of metal that is treated with a silicone or varnish coating. They are used for water, gas, and oil pipelines, and their outside surface is generally smooth. The inside of cast iron pipes is also coated so that the metal does not rust. They have several disadvantages over other materials for pipelines. They are heavy, expensive to repair if they break, and take a long time to heat up to their operating temperature. Does Home Insurance Cover Cast Iron Pipes? Here are some things to remember when researching whether …

Condominium Insurance Dispute? Don’t Do It Alone

Condominium insurance disputes are sometimes complicated because of the fact that condominiums are in a community. Areas such as the stairs/elevator, administrative office, and parking lot are common to all condo owners. This is why condo owners are sometimes confused when it comes to insurance claims. At RRBH Law, we understand the rights of individual condo owners and the rights of homeowner’s associations. We believe that understanding and recognizing the rights of each is vital to achieving positive results for our clients in the event of a condo property damage accident. Making a Condominium Insurance Claim for Losses The way condo owners handle a loss is slightly different than the situation faced by people who own single-family homes. Condo owners have their own unique set of rules governing their insurance. The homeowner’s policy a condo owner owns only covers some property damage, others may be covered by the building owner or HOA. The following are the most common condominium insurance claims that both an individual owner and the HOA may raise: Damage caused by molds Damage caused by fire (smoke damage included) Damage caused by wind (including other damages that can necessitate windows and roofs to be repaired) Damage caused …

How Long Does a Home Insurance Claim Take in Florida?

How long does a home insurance claim take in Florida? When you file a homeowners insurance claim in the Sunshine State, you might expect immediate relief. Here’s why that’s a mistake. While it is practically impossible to pinpoint how long an insurance claim will take to pay out, there are a few milestones you can rely on to get an idea about what to expect. It can take days, weeks, or even months—sometimes even years—before you see a single cent from your insurance provider. It all depends on the circumstances surrounding your claim. Here are some things to keep in mind as you wait for the insurance company to cut you a check. How long does a home insurance claim take in Florida? In Florida, insurance companies have 90 days to notify you whether they have accepted or denied your claim. If your insurance provider approves your claim, the Florida Statues state that they must pay you within 20 days of their decision. If they do not pay your approved claim within this timeframe, the payout will accrue an interest rate of 12% per year. The larger the claim, the more likely your provider is to use the whole …

What Does Home Insurance Cover? It May Be Less Than You Think.

What does home insurance cover? In this article, find out what exactly is covered on a homeowners insurance policy and how it helps you in the unfortunate event that something happens to your home. Homeowners insurance is a critical part of owning a home, but what does it actually cover in the event that you need to file a claim? Many people are unaware that most home insurance policies have precise language about what the insurance company will pay for in case of damage to your home. To make things easier for you, we have compiled some of the common items that are covered and one that usually is not. Dwelling and Other Structures Covered items vary by policy, but many policies include your home and other structures on your property. This often includes outbuildings on the property (such as a garage), walking surfaces (such as steps or a porch), and detached structures that are not attached to the main dwelling structure (such as a shed). Because each policy is unique, you should read your policy to determine what is included under your coverage. Personal Property Personal property is what you would find inside a home. This includes furniture, electronics, …

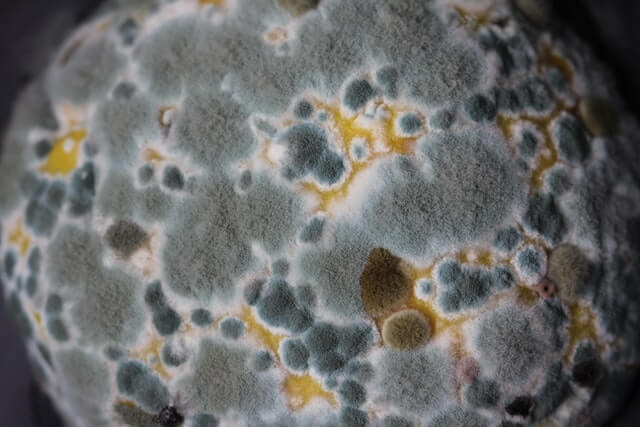

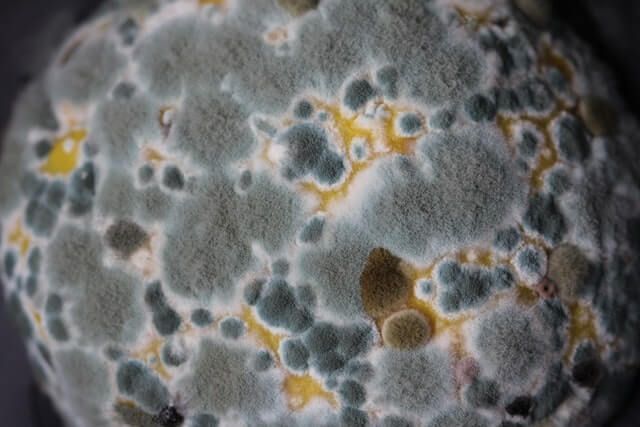

How Much Does Mold Remediation Cost?

When water, dirt, or other materials get into your home through a broken pipe or leaky roof and cause mold to grow, it can be frustrating. How much does mold remediation cost? Discover the main factors that can make the cost of mold remediation vary in this article! It might seem like a simple thing: just remove the mold from your house and go on with your day. However, there is much more to the mold remediation process than that. How much it costs and what you can do to prevent it are two critical questions that homeowners need to answer. We answer these questions in this article. How much does mold remediation cost? Mold remediation costs vary depending on factors such as the type of water damage, the severity and extent of the mold, and the amount of required cleanup. The average cost of mold remediation is about $2,300, though it often ranges between $1,300 and $3,300. High-cost jobs can cost as much as $6,000. There are many monetary costs associated with mold remediation, but the cost that is most important is the cost of living in a contaminated home or office. Molds and mildew can cause respiratory problems, …

Cast Iron Pipe Lawsuit: Does Home Insurance Cover Cast Iron Pipes?

Has your home insurance provider denied your claim? It might be time to file a cast iron pipe lawsuit. Your home should be a place where you can sit back, relax, and enjoy yourself. Unfortunately, for many homeowners with cast iron plumbing, home seems to be a constant source of stress. Cast iron is prone to corrosion, which can cause thousands of dollars of property damage if it forms a leak. Replacing cast iron pipes can cost tens of thousands. Will your homeowners insurance cover repairs? If your insurance provider decides to put profits over honoring your policy and denies or underpays your claim, you don’t have to sit there and take it. You have options. Here’s what you should know about cast iron plumbing, insurance, and filing a lawsuit if you are denied. Does home insurance cover failing cast iron pipes? Insurance companies often try to pass off damage caused by leaking cast iron pipes as the homeowner’s fault. While plumbing maintenance falls to the homeowner, you might be eligible for coverage in some cases, but your insurance provider will not make the process easy for you. Here are a few things you can do to increase your chances …

How to Identify Roof Wind Damage and Get Your Claim Settled

Worried that your roof might have been damaged by high winds? In this article, we break down how to identify roof wind damage so you can start the claim process. The next time you are outside, take a look at your roof. Do you notice anything…off? Do the shingles look worn? Does anything seem to be missing? Some indications that high winds have damaged your roof are easy to spot—you may even be able to see them from the street. Others may require a closer inspection. Either way, it’s critical to know how to identify roof wind damage to prevent serious issues like leaking ceilings and mold. If you are even slightly concerned about the state of your roof, these tips will help you identify problems so you can notify your insurance. When to Look for Roof Wind Damage When winds reach 45 mph or higher in your area, you should take some steps to ensure that your roof is still in good shape. At this speed, dead tree limbs can fall onto your roof and damage the shingles. At higher speeds, the wind can even rip shingles completely off their nails. Wind speeds of 75 mph and higher are …

Is It Safe to Stay in a House with Mold? Why You Should Limit Exposure

Is it safe to stay in a house with mold? While it might seem like mold is not a big deal, when it comes to your health, you shouldn’t write it off completely. Aside from the damage it can cause to your home; mold is also often hazardous if you are exposed to it for prolonged periods. In Florida, because of the high humidity levels and frequent hurricanes, mold is a common household problem, so most homeowners will have to deal with it at one point or another. If you are worried about the health effects of mold in your home, here are a few things to know. Is it safe to stay in a house with mold? Mold can cause reactions that range from mild to severe. Those who are more susceptible to the negative effects of mold exposure—such as people with respiratory conditions like asthma, mold allergies, and suppressed immune symptoms—are more likely to become seriously ill. Exposure over a few days may not be harmful, but staying in a home with active mold growth can cause symptoms. So, is it safe to stay in a house with mold? For many people, the answer is no. In general, …

The Most Dangerous Part of a Hurricane Can Leave Your Home in Ruin

Though high winds can cause significant damage to your home, they are not the most dangerous part of a hurricane. Learn about the dangers of storm surge and how to protect your property. During a hurricane, storm surge is the most dangerous threat to life and property. About half of lives lost during hurricanes are due to storm surge, and billions of dollars in property damage is possible from a single storm. To help you understand the risk of storm surge as we make our way into hurricane season, here are some facts about this hazard and what you can do to protect yourself. The Most Dangerous Part of a Hurricane: What Is Storm Surge? Storm surge refers to the abnormal rising water levels near the coast caused by high hurricane winds. Water is displaced onto coastal land, causing flooding in low-lying areas. When combined with rough ocean waves, storm surge can not only cause water damage and mold infestation to at-risk homes but also structural damage. During especially destructive storms, these factors can make your home uninhabitable. Steps to Take to Protect Your Home If your home is located in an at-risk area, it is critical to be ready …

Need a Lawyer for Hurricane Insurance Claim? Only If You Want a Fair Settlement

Should you hire a lawyer for your hurricane insurance claim? It depends on your situation, but your settlement could benefit. Here’s how. This year is going to be another busy Atlantic Hurricane Season, according to the Colorado State University Tropical Meteorology Project. “We anticipate that the 2021 Atlantic basin hurricane season will have above-normal activity,” Dr. Phil Klotzbach, the leading scientist on the project, wrote in the 2021 report. If you have not already begun preparing your home and yourself for the possibility that your home could be damaged, you should begin doing so as soon as possible. You should also educate yourself about what to do following a hurricane. If you want a fair settlement, here are a few reasons you might need to hire an attorney. Benefits of Hiring a Lawyer for Hurricane Insurance Claim When you are considering whether to hire an attorney to handle your hurricane insurance claim, you might have a few questions. How will an attorney help me with my claim? Will it be worth it? Hurricane insurance claims can be time-consuming, complicated ordeals. Having a lawyer on your side can make the process easier and more streamlined. Here are a few things that …

Why Mold Insurance Claims Get Denied

Words are important, especially in the legal industry. Homeowners insurance policies are often vague in their wording when it comes to mold coverage. Insurance providers sometimes deny mold insurance claims because of how a policy lays out what it covers—for the homeowners who receive a denial, that can mean they are out thousands of dollars. In a typical mold coverage case, the fate of the claim often hinges on one thing—whether the mold is a result of covered damage. Here’s what you need to know about mold insurance claims. When Does Homeowners Insurance Cover Mold? As mentioned above, in most homeowners insurance policies, mold removal is only covered when it is the result of a covered peril. Therefore, if a pipe bursts (or you experience other covered water damage) and the moisture causes mold to grow, you could file a claim for mold removal and the repair of anything permanently damaged by the mold, as well as any damage caused by the water. The primary stipulation to remember is this: if your homeowners insurance policy covers sudden, accidental water damage, you should be covered if any mold results from the water damage. Here are a few common examples of covered …

Personal Liability Insurance: What Is It and Why Is it So Important?

Personal liability insurance coverage is among the most important parts of any homeowner’s or renter’s insurance policy. If you are ever liable for damages because of property damage or personal injury, your liability insurance coverage provides protection. In this article, we examine some of the basic aspects of liability coverage, including what it is, what it does and does not cover, and some of the consequences of not having adequate coverage on your policy. Here are a few things you should know. What Is Personal Liability Insurance? Personal liability coverage is included in homeowner’s and renter’s insurance policies to protect the owner of the policy. Without this coverage, their personal assets could be at risk if they are ever sued. This type of coverage also pays for the cost of defending against any lawsuit brought against the liable party. Personal liability insurance covers a few different types of damages: bodily injury and property damage. Bodily injury covers medical expenses when someone is injured on your property. Examples include the following: Hospital costs Ambulance costs Medical and surgical procedures X-ray services Dental costs Funeral costs The policy covers costs when a lawsuit is brought against the policy owner due to the …

4 Things Your Homeowners Insurance Company Won’t Tell You (But Your Homeowners Insurance Lawyer Will)

Homeowners insurance is notoriously complicated and confusing. In fact, many policyholders hope they never have to use theirs because they do not understand the ins and outs of their coverage. The insurance companies are counting on your confusion. Will you let them get away with denying coverage, or will you hire a homeowners insurance lawyer to clear things up? If you haven’t had to think too much about your homeowners insurance, consider yourself lucky. Being able to forget about what your policy covers means you have not had to file a claim in some time (perhaps ever). Then again, if you haven’t had to use your coverage recently, that means you might need a refresher on what your policy covers and what it does not cover. And even if you know what is included in your policy, do you really understand how it all works? Your insurance company would rather keep you in the dark about some pretty important aspects of your policy. Here are a few. You May Be Entitled to Replacement Rather Than Repairs If you purchased a policy that stipulates you are entitled to the replacement cost of a damaged item or part of your home, you …

These 4 Steps Could Help You Get the Most from Your Hurricane Insurance Claim

No one knows when the next big hurricane is going to hit, so it is impossible to predict when you will need to file a hurricane insurance claim. Understanding the steps that you need to take after your home or property is damaged will not only help to speed along recovery time—it can also lead to a bigger claim check. Hurricane claims are some of the most stressful to file considering the devastation that can occur. Furthermore, your insurance company is likely to be overwhelmed by claims, which can slow recovery times. In many cases, the amount people receive from their insurance is less than they deserve, so when you know how to move forward, you are less likely to be taken advantage of by the insurance company. Many of the provisions included in a typical insurance policy are confusing, and it can be difficult to tell what your policy actually covers. To prepare for a worst-case scenario in which you have to file a hurricane insurance claim, you should review your insurance policy, if possible, with the help of an attorney. Which brings us to the first step you should take after a hurricane damages your property. Call Your …

How Does the Roof Insurance Claim Process Work? 5 Things to Know When Filing

As most Floridians know by now, the 2020 Atlantic hurricane season is going to be a busy one. Hurricane Isaias, though only a Category 1 hurricane, caused widespread damage to homes across the east coast. One of the most common types of damage that can happen to a home during a hurricane is roof damage, which begs the question for homeowners: How does the roof insurance claim process work? When you file a claim, these five things are good to know. Making a Claim with Your Insurance After a storm damages your roof, the first thing you probably think you need to do is contact your insurance. While you do not want to procrastinate when filing a claim, it is in your best interest to consult with a property insurance attorney to make sure you are protected. Many insurance companies, to avoid losing revenue, will deny or underpay claims, sometimes in bad faith. When you have an attorney from the start of the process, you can ensure that they will take your claim seriously. Make Temporary Repairs Repairs take time, but you cannot wait to protect your home from suffering more damage from the elements. Be sure to document the …

Hurricane Irma Claim: The Window to File Is Closing

Hurricane Irma resulted in over 838,000 residential property insurance claims. And although the storm that devastated the entire state of Florida occurred in September of 2017, it is still possible to file a claim. Damage from the hurricane has totaled nearly $50 billion. And some Florida homeowners still have not had their Hurricane Irma claims settled—roughly 7 percent, to be exact. According to this Florida statute, affected parties must file a claim with their insurance company within 3 years of the date the hurricane made landfall. Hurricane Irma made landfall in Florida on September 10, 2017, which gives policyholders until September 9, 2020 to file. Don’t let the fear of a denial stop you from submitting a Hurricane Irma claim It’s common for homeowners to feel as though their claim will be denied. Horror stories of dealing with insurance companies are always talking points for aggravated policyholders. And with exposure via social media to an even broader group of angry individuals whose claims have gone denied, the stigma grows even greater. Fear of a denial holds many policyholders back from filing in the first place. This is especially true during hurricane season, when deductibles are higher. As the holder …

Mold in the Home: Will Insurance Pay for This Health Hazard?

In mid-September of last year, southern Florida experienced the power that remained of Hurricane Irma. Though only a category 2 hurricane when it made landfall in the contiguous United States, the damage that the storm caused reached over $50 billion and cost 90 people their lives. Irma has long since dissipated, her wreckage cleared, but she has left many people to deal with a serious health risk: mold in the home. Many in Florida will be feeling the effects—possibly for years to come, if Hurricane Katrina was any indication—of the mold spores that implanted themselves in the drywall, carpet, and wood of countless homes and businesses. These spores remain like a memory of Irma’s damage. What this means for homeowners is that if left unchecked, mold can take over and make a home uninhabitable. And that means fixing the problem is of the utmost importance. So how will you pay to fix your mold in the home problem? Let’s take a look at, first, why it is such a serious issue, and then, what to do if your insurance provider denies your claim. Why Mold in the Home is Serious There are many strains of mold, some extremely toxic and …