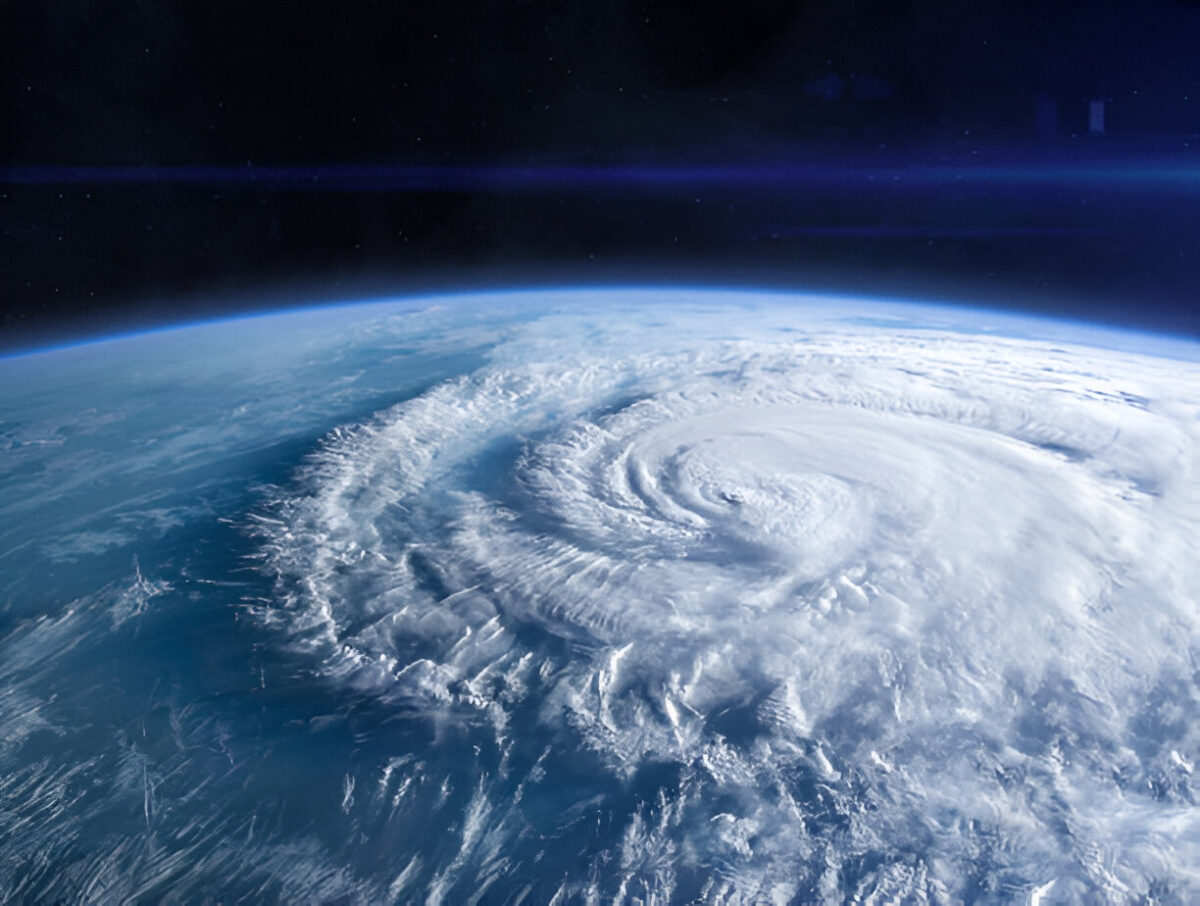

The 2024 hurricane season was one for the record books. It brought destruction, record-breaking storms, and some stark lessons about preparedness and climate trends. For Floridians, who are no strangers to hurricane threats, this season was a chilling reminder that vigilance, preparation, and understanding our changing environment are more important than ever. The 2024 hurricane season produced 18 named storms, 11 hurricanes, and 5 major hurricanes, exceeding the historical average. It was a season marked by destruction and resilience. But what can we learn from it to better prepare for the future? In this blog, we’ll dive into the most important takeaways, explore the factors that fueled the season’s intensity, and discuss why these lessons are crucial for every Floridian. How Many Hurricanes Struck Florida in 2024? The 2024 hurricane season was not only active but also destructive. Florida experienced multiple direct impacts, with two major hurricanes making landfall and causing significant damage. The state endured high winds, catastrophic flooding, and widespread power outages. Thousands of residents were displaced, and communities from the Panhandle to the Keys are still recovering. In total, the season produced: 18 named storms. 11 hurricanes. 5 major hurricanes (Category 3 or higher). These numbers are …

4 Secret Tactics of an Insurance Claim Adjuster

When you file an insurance claim, you expect fair treatment and a swift resolution. However, navigating the complexities of insurance claims can be daunting, especially when faced with the tactics employed by insurance claim adjusters. These professionals are skilled in maximizing profits for their companies, often at the expense of claimants. In this blog, we’ll delve into the common insurance claim adjuster’s secret tactics and how you can protect yourself. What are an Insurance Claim Adjuster’s Secret Tactics? Building Trust to Minimize Payouts One primary tactic insurance claim adjusters use is building trust with claimants. They may present themselves as empathetic and understanding, aiming to establish rapport. While this may seem genuine, it often serves the purpose of minimizing payouts. By appearing friendly and cooperative, adjusters may persuade claimants to settle for less than they deserve. It’s essential to remember that adjusters represent the interests of the insurance company, not the claimant. To counter this tactic, maintain a level-headed approach and avoid divulging unnecessary information. Stick to the facts of your claim and refrain from discussing personal matters with the adjuster. Additionally, consider seeking guidance from a legal professional who can advocate for your rights and ensure fair treatment throughout …

Comparative Negligence Explained: If I’m Partially at Fault, Can I Still Sue?

Have you found yourself in a situation where you believe you are partially at fault for an accident? For example, you were speeding or texting while driving, resulting in a collision. It’s natural to wonder what is comparative negligence and if you still have the right to sue for damages. The good news is that you can still pursue legal action, but you must be aware of comparative negligence laws. In this blog, we will delve into what comparative negligence is, how an attorney can help establish it, and the damages you can seek in your personal injury claim. What Is Comparative Negligence? Personal injury accidents can happen at any time, leaving individuals with physical, emotional, and financial damages. But what happens when the injured party is partially at fault for the accident? Can they still sue for damages? In Florida, the answer is yes, thanks to the concept of comparative negligence. Comparative negligence is a legal principle determining the percentage of fault for each party involved in an accident. This principle is used to assess liability and determine the amount of damages a plaintiff can recover. For example, if you are injured in an accident, your recovery can be …

Can You Sue a Nursing Home For Negligence?

“Can You Sue a Nursing Home For Negligence?” This is a question that many families ask when their elderly loved one is subjected to mistreatment or abuse in a nursing home. As the trial for a Hollywood Hills nursing home administrator begins this month for the negligence the nursing home showed its residents during Hurricane Irma shows, it’s an important question to answer. Negligence can take many forms and can cause harm to residents in numerous ways, from medical to physical, emotional, or financial abuse. This article will provide a brief overview of nursing home negligence and the legal options available to families who have suffered due to the actions or inaction of a nursing home or its staff. Can You Sue a Nursing Home For Negligence? Yes, you can sue a nursing home for negligence if you have suffered injuries or financial loss due to poor treatment in the facility. The following laws are relevant in a nursing home negligence case: Florida Nursing Home Bill of Rights This law, found in Florida Statutes 429.28, outlines the rights of individuals living in care facilities. It states that residents have the right to live free of physical, mental, emotional, and financial …

What Types Of Property Damage Should Floridians Know About?

Have you ever wondered what types of property damage should Floridians know about? You may have considered hurricane or tornado damage, but did you know there are other ways your home could be damaged? Read on to learn about some of the most common property damages and how to prepare for them. What Types of Property Damage Are Most Likely in Florida? In Florida, property damage can include anything from broken windows to structural damage. Knowing what to look for in a property damage claim can help you get the compensation you deserve. Here are some common types of property damage in Florida: Wind and Hail Damage Florida’s weather is hazardous and accounts for a large number of insurance claims. Hail and wind damage are the most frequent types of weather-related insurance claims. The leading causes of wind and hail damage to property in Florida are windstorms, hailstorms, tornadoes, and hurricanes. To cover wind and hail damage, one may occasionally need to acquire a different policy, so be sure you know what your current policy covers. Water and Freezing Damage Florida homeowners may sometimes incur water damage from rain, flooding, plumbing defects, or melting ice – as well as from …

What Happens When You Are Injured in a Store? 3 Things to Know

Do you know what happens when you are injured in a store? If you have never had a slip and fall accident, you probably do not know what to do if something happens while you are shopping. These accidents, unfortunately, happen every single day in Florida and around the country. You never know when you could come across unsafe conditions—even if the hazard is a simple puddle of milk on grocery store linoleum, a slip and fall can lead to a lifetime of pain and suffering. You must be prepared for anything, and that means knowing what happens when you’re injured in a store. Here are a few things you should know in case it happens to you. Obligation to Maintain a Safe Premises When a store is open to the public, it is obligated to keep the premises safe for patrons. If the store does not adequately maintain the premises, anyone who is injured may have cause to file a lawsuit to recover damages for injuries. Injuries that are a result of the negligence of the store can be serious, leading to long recovery times, costly hospital bills, and even permanent pain. What happens when you’re injured in a …

Big Changes Coming for COVID-19 Insurance Claims

COVID-19 insurance claims denied? Business interruption insurance is created for times like this. If you’ve been paying your premiums, you deserve a payout.

Hurricane Irma Claim: The Window to File Is Closing

Hurricane Irma resulted in over 838,000 residential property insurance claims. And although the storm that devastated the entire state of Florida occurred in September of 2017, it is still possible to file a claim. Damage from the hurricane has totaled nearly $50 billion. And some Florida homeowners still have not had their Hurricane Irma claims settled—roughly 7 percent, to be exact. According to this Florida statute, affected parties must file a claim with their insurance company within 3 years of the date the hurricane made landfall. Hurricane Irma made landfall in Florida on September 10, 2017, which gives policyholders until September 9, 2020 to file. Don’t let the fear of a denial stop you from submitting a Hurricane Irma claim It’s common for homeowners to feel as though their claim will be denied. Horror stories of dealing with insurance companies are always talking points for aggravated policyholders. And with exposure via social media to an even broader group of angry individuals whose claims have gone denied, the stigma grows even greater. Fear of a denial holds many policyholders back from filing in the first place. This is especially true during hurricane season, when deductibles are higher. As the holder …

Bad Faith Claim in Florida: How Can I Pursue Legal Action?

When you have a policy with an insurance company and you file a claim, you expect them to keep their end of the bargain. In fact, it’s a violation of Florida state law for an insurance company to deny coverage without cause. The insurance company is supposed to act in good faith with its policyholders. Yet bad faith insurance practices still occur all the time. What happens if you are the victim of an insurance provider’s bad faith practices? One option that you have is to file a bad faith claim in Florida so that you stand a chance to see the money that you are owed. Bad Faith Insurance Practices Insurance companies can act in bad faith in many different ways. The first, known as a wrongful denial of benefits, occurs when a company fails to pay the policyholder as laid out in the policy. But denying a payment isn’t the only bad faith practice that an insurance company can be guilty of. Other examples of bad faith practices include: Failing to conduct an adequate investigation of your claim Failing to reply to a claim promptly with a denial or a settlement Delaying payment Offering less money than the …

Bad Faith Insurance: Are You REALLY Protected When It Matters?

We’ve all seen them—advertisements that portray the insurance company as a protector. When everything goes right, this portrayal can ring true. But what about bad faith insurance practices? Your insurance provider is supposed to act as a suit of armor for your and your loved ones. You hope you won’t need it, but you pay for it anyway, just in case the worst happens. When your insurance company acts in bad faith, it’s as if you were imagining that you were wearing the armor the whole time—when that happens, you need to take action. What Is Bad Faith Insurance? Insurance companies—as many of their ads claim—are supposed to protect their policyholders. When an insurance company fails to do so, either intentionally or negligently, that is what is known as a bad faith insurance practice. Insurance companies have an obligation by law to act in good faith. What that means is that when you file a claim, your insurance provider shouldn’t look for ways out of investigating the claim or paying you what they owe you. A Look at a Bad Faith Insurance Case Way back in the 1990s, the former owner of an auto repair shop had to file a …

Insurance Denied My Claim. Now What?

If your insurance company denies your claim, is there anything more you can do? A good number of victims feel stranded when the insurance company says no. But take heart as it is certainly not over at that point. Remember that an insurance company is a business with a profit motive and if they can find a way to deny your claim it will help their financial performance. They will certainly interpret the language of the policy to their advantage. Your insurance company may deny your claim for one or more of the following reasons: A policy exclusion, for example the policy doesn’t cover that category of loss The claim wasn’t filed within a particular time limit The incident happened outside of your policy coverage dates However, when they do deny your claim they must provide you with a reason. They must also notify you of your right to challenge a claims decision as failure to do so waives other rights they have in the policy. There are times when an insurance company may not act in good faith. We have seen cases of insurance companies who have wrongfully cancelled a policy, raised premiums after a claim, delayed payment without …