Rear-end accidents happen every day on Florida roads. If someone hits you from behind, it can seem like a minor thing at first. But what feels like a small bump can turn into a big problem—especially when injuries show up hours or days later, or when the insurance company doesn’t want to pay. As Florida rear end accident lawyers, we see this all the time. People try to handle things on their own, then get stuck when the other driver denies fault or the insurance company lowballs the claim. That’s why knowing what to do right away matters. Who Is at Fault in a Rear End Accident? In most Florida rear-end accidents, the driver who hits the car in front is legally presumed to be at fault. That’s because drivers are expected to leave enough space to stop safely, even if the vehicle ahead brakes suddenly. But that’s not always the end of the story. Florida courts recognize that there are exceptions. For example: If the front car stopped suddenly without a valid reason (not for traffic or safety), If the front car had non-working brake lights, or If the front car cut off the rear driver dangerously just before …

What to Do if a Contractor Damages Your Property: Advice from a Florida Property Damage Lawyer

According to the Department of Business and Professional Regulation (DBPR), the state received 9,831 contractor-related complaints during the 2022–2023 fiscal year. Of those, 4,699 were found legally sufficient, 1,007 resulted in formal administrative complaints, and 773 led to final disciplinary orders. That’s a clear sign that contractor-related issues, including property damage, are more common than most homeowners realize. At RRBH Law, we’ve helped many Florida homeowners hold negligent contractors accountable. This blog will walk you through what to do if a contractor damages your property, based on real-world experience and Florida law. If you’ve been searching for a property damage lawyer or “property damage attorney near me,” this guide is your first step toward resolution. What to Do if a Contractor Damages Your Property Document the Damage Immediately Before you talk to anyone or touch anything—take photos. Start by snapping pictures and videos of the damage from every angle. This helps show exactly what happened and when. Make sure to capture: Wide shots of the entire room or area Close-ups of any cracks, stains, broken items, or debris Video walkthroughs if helpful Any tools or materials left behind that may have caused the damage Keep the original files and back …

Why You Need a Ridesharing Accident Lawyer After an Uber or Lyft Crash

Ridesharing services like Uber and Lyft have made getting around more convenient. But when an accident happens, the situation can quickly become complicated. Who is responsible? Which insurance policy covers your injuries? How do you make sure you get the compensation you deserve? These are not simple questions. Unlike regular car accidents, rideshare crashes involve multiple parties, corporate policies, and complex insurance rules. Uber and Lyft classify their drivers as independent contractors, meaning they often try to avoid responsibility when something goes wrong. This is why hiring a ridesharing accident lawyer is important. A lawyer with experience handling Uber and Lyft accidents can help you understand your legal rights, deal with insurance companies, and fight for the compensation you need. RRBH Law has a dedicated team that knows how to navigate these cases and will work to protect your interests. What Makes Rideshare Accidents Different from Regular Car Accidents? At first, an Uber or Lyft accident may seem like any other car crash. But legally, there are important differences that make these cases more complex. Rideshare Insurance Coverage is Complicated Unlike regular accidents where the at-fault driver’s insurance pays for damages, rideshare drivers are covered by different policies depending on …

What Is the Average Personal Injury Settlement in Florida?

One moment, you’re going about your day, and the next, you’re facing medical bills, lost income, and the stress of figuring out what to do next. If the accident wasn’t your fault, you might be wondering: What’s the average personal injury settlement worth in Florida? The answer depends on several factors, including the severity of your injuries, medical costs, and whether you’re able to work. Settlements can range from a few thousand dollars for minor injuries to hundreds of thousands—or even millions—if the injuries are severe. In fact, data from the Insurance Information Institute shows the average car accident settlement in the U.S. is around $23,900, though serious cases often result in much higher payouts. If you’re dealing with an injury claim, it’s important to understand what affects your potential settlement—things like medical bills, pain and suffering, and liability. In this guide, we’ll walk you through the key factors that influence personal injury settlements in Florida, typical payout amounts, and what you can do to maximize your compensation. What Types of Compensation Can You Recover After a Florida Car Accident? Medical Expenses Florida operates under a no-fault insurance system, meaning your Personal Injury Protection (PIP) covers up to $10,000 in …

What Is Hazard Insurance for Homeowners and What Does It Cover?

As a homeowner, one of your biggest priorities is making sure your property is protected. But with so many insurance options, it can be tough to figure out exactly what you need. It’s an important part of your homeowner’s insurance and can really help when disaster strikes. In 2023, the National Oceanic and Atmospheric Administration (NOAA) reported weather-related disasters caused a staggering $93 billion in damages across the U.S. From wildfires to storms, these events are unpredictable and happen more often than we’d like. So, what is hazard insurance for home going to protect you against? It’s the coverage that helps you recover if your home is damaged by things like fire, severe storms, or even sinkholes. But what exactly does it cover, and how does it work? What Is Hazard Insurance for Home? It is a type of coverage that protects homeowners from damage caused by a variety of natural disasters and events. Essentially, it’s the insurance that covers your home from physical damage brought about by things like fires, severe storms, hail, snow, and even sinkholes. As long as the event is covered under your specific policy, hazard insurance can help cover the costs of repairing or replacing …

Truck Accident Lawsuit: A Complete Guide to Filing Suit in Florida

Truck accidents are a serious issue; every year, many people are left dealing with their aftermath. In 2023, the Florida Department of Highway Safety and Motor Vehicles (FLHSMV) reported 10,417 crashes involving large trucks in Florida. This shows just how dangerous these accidents can be, often leading to severe injuries that change lives forever. If you’ve been in a truck accident, it’s important to know what your options are, especially if you decide to file a lawsuit. Truck accident claims are much more complicated than regular car accidents, and the legal process can be hard to understand. In this blog, we’ll break down everything you need to know about filing a truck accident lawsuit in Florida. What Makes Truck Accident Claims Different and Complex? Multiple Parties Involved In a standard car accident, the liability usually falls on one party—the driver. However, in truck accidents, things aren’t so simple. Liability can extend to multiple parties beyond just the truck driver. For example, trucking companies, vehicle manufacturers, and even maintenance service providers can all play a role in causing the accident. Did the truck company push their driver to meet impossible deadlines, causing fatigue? Were the truck’s brakes malfunctioning due to poor …

What Is Actual Cash Value vs. Replacement Cost in Property Insurance?

“Insurance is not meant to profit the insured; it is meant to restore them.” This widely recognized principle raises a vital question for property owners: How much will your insurance actually pay to restore your property after a loss? The answer often hinges on whether your policy is based on actual cash value vs replacement cost (ACV vs. RCV)—a distinction that can significantly impact your recovery. According to the Insurance Information Institute, most homeowners misunderstand the distinctions between these terms until it’s too late—when they file a claim. Knowing the difference can significantly impact your ability to recover after property damage. What Is Actual Cash Value vs. Replacement Cost in Property Insurance? ACV Meaning in Property Insurance Actual Cash Value reflects the current market value of your damaged property, considering depreciation. Depreciation accounts for the item’s wear and tear, age, and use. For example, if a ten-year-old roof sustains damage in a hurricane, an ACV insurer will calculate the payout based on what the roof is worth today—not what it costs to replace. If the roof cost $20,000 to install but is now worth $8,000 due to age and wear, your payout will be based on $8,000. You’ll likely need …

Florida’s Laws on Personal Injury Protection (PIP) and Their Impact on Florida PIP Insurance Claims

“Florida’s auto insurance premiums are among the highest in the country, averaging $2,208 per year.” This eye-popping stat highlights how important it is to understand Florida’s Personal Injury Protection (PIP) laws. These laws are the backbone of the state’s no-fault insurance system, designed to streamline medical payments and reduce litigation. However, navigating the nuances of PIP can be challenging, especially when dealing with claims or denials. Let’s break down what Florida’s PIP insurance laws mean for you, their benefits, recent legislative attempts to change them, and how they impact insurance claims. What Does No-Fault System Mean? Florida is one of only two states that require drivers to adhere to a no-fault auto insurance system. The term “no-fault” doesn’t mean no one is responsible for an accident. Instead, it ensures that drivers turn to their insurance policies to cover injuries regardless of who caused the crash. This structure is meant to expedite payments for medical expenses and reduce the need for litigation. Focusing on immediate medical coverage, the no-fault system aims to ensure accident victims get the care they need without lengthy court battles over fault. What are the Benefits of PIP Law in Florida? Florida’s PIP law is designed to …

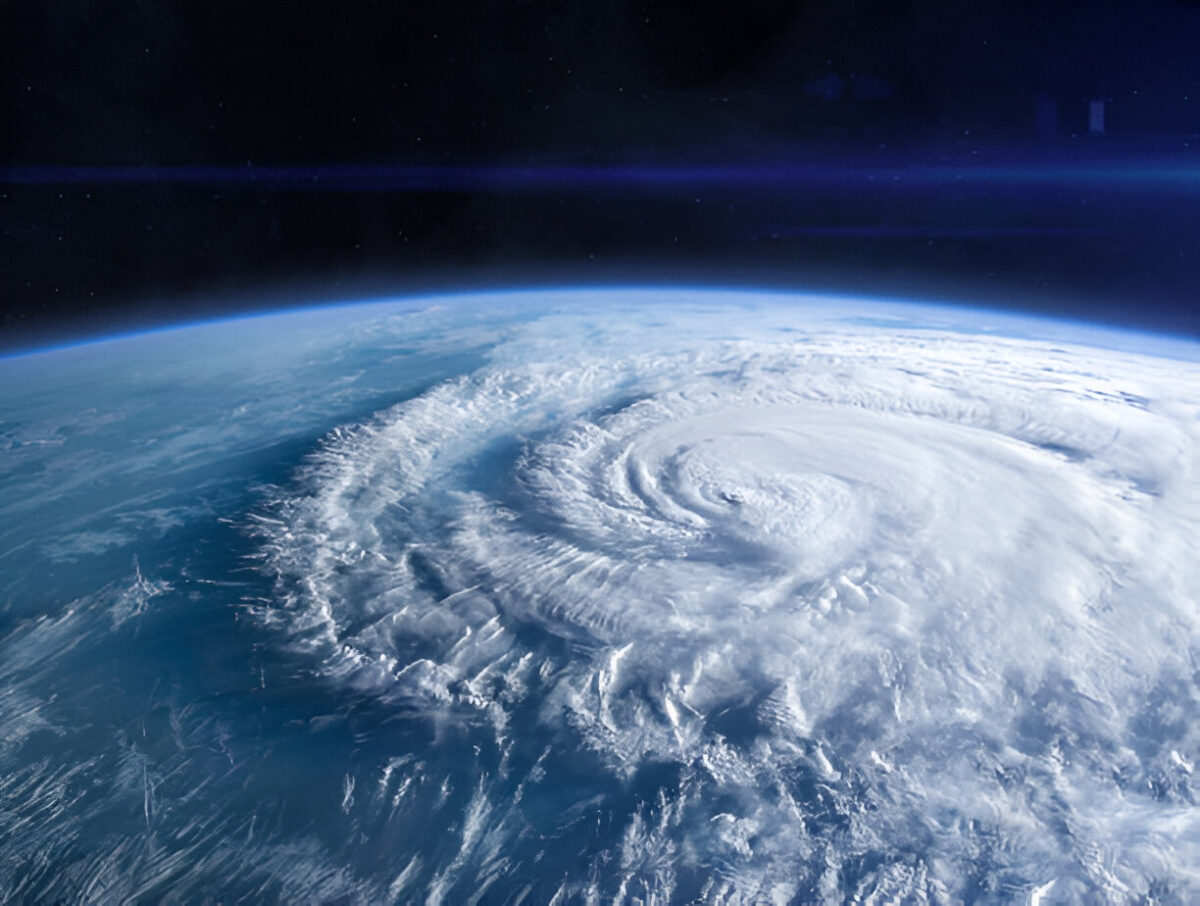

3 Crucial Lessons from the 2024 Hurricane Season Every Floridian Should Know

The 2024 hurricane season was one for the record books. It brought destruction, record-breaking storms, and some stark lessons about preparedness and climate trends. For Floridians, who are no strangers to hurricane threats, this season was a chilling reminder that vigilance, preparation, and understanding our changing environment are more important than ever. The 2024 hurricane season produced 18 named storms, 11 hurricanes, and 5 major hurricanes, exceeding the historical average. It was a season marked by destruction and resilience. But what can we learn from it to better prepare for the future? In this blog, we’ll dive into the most important takeaways, explore the factors that fueled the season’s intensity, and discuss why these lessons are crucial for every Floridian. How Many Hurricanes Struck Florida in 2024? The 2024 hurricane season was not only active but also destructive. Florida experienced multiple direct impacts, with two major hurricanes making landfall and causing significant damage. The state endured high winds, catastrophic flooding, and widespread power outages. Thousands of residents were displaced, and communities from the Panhandle to the Keys are still recovering. In total, the season produced: 18 named storms. 11 hurricanes. 5 major hurricanes (Category 3 or higher). These numbers are …

Holiday Travel Safety: How to Avoid Bad Car Accidents

The holidays are a time for celebration, family gatherings, and memorable road trips. But here’s a sobering reality: the holidays are also one of the most dangerous times to be on the road. According to the National Highway Traffic Safety Administration (NHTSA), nearly 30% of bad car accidents during the holiday season involve alcohol. Couple that with increased traffic and stress, and the potential for bad car accidents skyrockets. Don’t let a preventable accident ruin your holiday. In this blog, we’ll explore essential holiday travel safety tips, the latest Florida car accident statistics, and how to safeguard yourself and your loved ones on the road. Whether traveling across town or across the country, understanding the risks and how to manage them is key to arriving safely at your destination. What Are the Latest Florida Car Accident Statistics for 2024? Florida’s roads are busier—and more dangerous than ever. According to the Florida Highway Safety and Motor Vehicles (FLHSMV), 331,903 car crashes have already occurred in the state in 2024. Here’s the breakdown: Fatal accidents: 2,423, resulting in 2,589 deaths. Injuries: 214,197 people suffered injuries, some life-altering, in these crashes. These numbers underscore the importance of driving with caution, especially during peak …

How Can I File a Claim for a Car Accident Brain Injury?

Car accidents are unfortunately common, but they’re not always just a “bump in the road.” In severe cases, these collisions can result in traumatic brain injuries (TBIs), changing lives in an instant. According to the Centers for Disease Control and Prevention, around 1.5 million Americans suffer from TBIs every year—and many are linked to car accidents. A brain injury from a car accident can lead to life-altering consequences, from memory issues and mood swings to physical impairments and financial struggles. Knowing how to file a compensation claim is critical if you or a loved one has experienced this. Filing a claim for a car accident brain injury in Florida can be a complex process. Understanding your legal rights and taking the proper steps are essential to obtaining the compensation you deserve to cover medical expenses, lost wages, and other damages. This guide outlines what’s involved in filing a claim, Florida’s statute of limitations, and why time is of the essence in personal injury cases. Statute of Limitations for Brain Injury Claims in Florida—and Why Timing Matters Florida law places a statute of limitations on personal injury cases, including traumatic brain injury (TBI) claims from car accidents. Generally, the statute of …

Do I Need Flood Insurance? Here’s Why It’s a Good Idea

Floods are the most common and costly natural disaster in the United States. According to FEMA, just an inch of water can cause over $25,000 in damage to a home. That’s not a statistic most homeowners consider—but it’s a reality many face. Florida is especially prone to flooding, with its low-lying coastal areas and heavy rains. The good news? Flood insurance can offer critical financial protection. Whether you’re a homeowner or a renter, this type of coverage can save you thousands in repair costs and provide peace of mind. So, do I need flood insurance? The answer may surprise you. What are the Financial Risks Associated with Flooding? Floods cause far-reaching and often devastating damage. When floodwaters invade a property, they can destroy floors, walls, electrical systems, and personal belongings. Repairing this damage is no small task. Without flood insurance, homeowners and renters have to bear these repair costs alone, which can quickly add up to tens of thousands of dollars. To see how much a flood might cost you, FEMA offers a Flood Cost Tool to give you a personalized estimate. For example, if your home has 1,000 square feet of space and experiences a six-inch flood, you could …

Hurricane Milton: Hurricane Preparedness Checklist to Keep Your Family Safe

With Hurricane Milton being one of the fastest-growing hurricanes since Wilma in 2005, the need for preparedness was never more urgent. This Category 3 storm slammed Florida’s Gulf Coast with torrential rain and 120 mph winds, submerging and devastating whole neighborhoods. Tragically, 24 lives were lost, and entire communities were left grappling with the aftermath. As rescue teams pulled residents from flooded homes and assisted living facilities, the satellite images of flooded homes near Siesta Key and Tampa were a stark reminder: hurricanes are unpredictable and dangerous. The good news is that hurricane preparedness can significantly increase your family’s safety during such events. Taking the right precautions and knowing what steps to take before, during, and after the storm can save lives and protect property. Below is a hurricane preparedness checklist to help you get ready for future storms like Hurricane Milton. Keep your family safe by starting your preparations now! What is the Latest Update on Hurricane Milton? As Hurricane Milton made landfall near Siesta Key on October 9, 2024, it became one of the most damaging storms to hit Florida’s Gulf Coast in recent years. Residents in the Tampa area saw their homes submerged, with floodwaters creeping into …

What is Subrogation and How Can It Affect Your Insurance Claim?

Did you know that your insurance company could have the right to go after a third party to recover the money they’ve paid out on your behalf? It’s called subrogation and could play a big role in your insurance claim. If you’ve ever filed a claim after an auto accident or a workplace injury, subrogation might already be working in the background without you knowing it. But what is subrogation? Understanding what it is and how it impacts your insurance claim is important. It’s one of those legal concepts that can directly affect the money you recover after an accident. In this blog post, we’ll walk you through exactly how subrogation works, the types of insurance policies it applies to, and why it matters to your final payout. What is Subrogation? Subrogation is when an insurance company can recover payment from the person at fault for an incident after covering your claim. If you’ve had an accident or injury, your insurance company may seek reimbursement for the damages they covered from the responsible party. Subrogation is a legal strategy insurance companies employ to shift the financial burden onto the party at fault rather than the blameless party or their insurance …

5 Reasons Why Hiring a Miami Car Accident Lawyer Is Worth It

Car accidents can be life-altering, leaving you with not only physical injuries but also emotional and financial stress. In fact, Florida is one of the top states for car accidents, with over 400,000 crashes reported each year. These numbers are staggering, and navigating the aftermath can be overwhelming, especially when insurance companies get involved. This is why hiring a Miami car accident lawyer can make all the difference. You may wonder: is it really worth the expense? The short answer is, yes! Let’s explore the five reasons why hiring a car accident lawyer in Miami is a smart investment. 5 Reasons Why Hiring a Miami Car Accident Lawyer Is Worth It Investigation and Collecting Evidence One of the initial tasks a Miami car accident attorney will perform is to investigate your case thoroughly. Even if you believe you can manage to collect police reports and capture photos, there are additional components involved in constructing a powerful claim. An experienced lawyer is aware of what to search for and gather. Your attorney will gather witness statements, secure surveillance footage, and if needed, hire accident reconstruction experts. These experts can reconstruct the scene to evaluate the events thoroughly. This could be crucial …

Does Homeowners Insurance Cover Plumbing?

Homeowners frequently encounter plumbing problems, which can be expensive to repair. As noted by the Insurance Information Institute, water damage makes up about 24% of all homeowner insurance claims annually. Many homeowners ask, “Does homeowners insurance cover plumbing?” Specifically, they wonder if their policy will cover plumbing damage from a burst pipe or accidental leak, which can lead to costly repairs reaching thousands of dollars. Finding the solution may be challenging, but correcting it could prevent significant financial strain. Knowing what your insurance includes in terms of plumbing is essential for preventing unforeseen costs. Let’s explore the specifics so you’re more equipped for any plumbing issues that may arise. When Does Homeowners Insurance Cover Plumbing? Accidental Leaks Unintentional spills from sources such as a malfunctioning water heater or damaged faucet can quickly lead to extensive destruction. If a sudden and unforeseen water leak occurs, your homeowners insurance will probably pay for the water damage and plumbing repairs. It is crucial to take prompt action, as delaying repairs can result in challenges when trying to get your claim authorized. Burst Pipes Experiencing a burst pipe is one of the most inconvenient plumbing problems a homeowner can face. Extensive damage may occur, …

What Does PIP Insurance in Florida Cover, and How Can It Benefit You After a Car Accident?

Car accidents can be sudden and result in substantial physical, emotional, and financial hardships. In Florida, having Personal Injury Protection (PIP) insurance is not just suggested—it’s mandatory as per the law. This insurance is meant to assist in handling the consequences of a car accident, no matter who caused it. Knowing the extent of coverage and advantages of PIP insurance can offer relief and financial protection in times of need. Is PIP Insurance Required in Florida? Yes, PIP insurance is required in Florida. All vehicles registered in the state must have at least $10,000 in PIP coverage. This insurance guarantees that individuals in a car accident can promptly receive medical treatment and payment for lost earnings without having to establish blame. The no-fault system lessens the load on the court system and speeds up the process of receiving compensation. As a policyholder, you can decide whether your PIP insurance will only cover you or include your whole household. This choice enables you to customize your insurance to meet your requirements, guaranteeing protection for all family members in case of an accident. What Does PIP Insurance Cover? PIP insurance in Florida offers a maximum of $10,000 in benefits that can be …

What are the Premises Liability Risks for Slippery Floors and Other Hazards in Florida?

Florida is known for its beautiful beaches, vibrant cities, and year-round sunshine, making it a popular destination for residents and tourists. However, with the state’s bustling public spaces and numerous businesses, the risk of accidents, particularly slip and fall incidents, is ever-present. Slippery floors and other hazards can lead to serious injuries, which may result in premises liability claims. Understanding the risks associated with such accidents and the legal framework governing premises liability in Florida is crucial for both property owners and visitors. What is the Statute of Limitations for Premises Liability in Florida? In Florida, property owners must maintain safe environments for all visitors. This duty is outlined in general negligence principles and Florida Statute § 768.0755, which covers slip and fall cases. To hold a property owner liable, the injured party must prove the owner knew or should have known about a hazardous condition and failed to address it. Constructive knowledge can be shown if the hazard existed long enough for the owner to notice and correct it or if the condition occurred regularly and was predictable. For instance, if a store doesn’t promptly clean a spill and someone slips, the store could be liable if it proves …