Even though insurance companies are required to act in good faith, many attempt to take advantage of the complex and intimidating nature of the claims process to pay less than they should. Any insurance dispute attorney knows that the insurance companies are going to do what they can to reduce the claims they have to pay out. But as they say, knowledge is power. Here are a few things you should know about the insurance claims process. Adjusters Know How to Negotiate It’s pretty easy to assume that the adjuster the insurance company sends is on your side. They’ve spent a lot of money cultivating that image with commercials that imply that they are going to take care of you like family. Unfortunately, that is not always the case. Insurance adjusters are trained in negotiation. For someone unfamiliar with the claims handling process, negotiating with an adjuster can be difficult, especially since they often ask questions that can be used by the insurance company to deny your claim. Talking to an insurance dispute attorney or even letting one take over the claims process for you can save you a headache in the future. Adjusters Want to Undervalue Your Claim In …

Hurricane Irma Court Case: How an Insurance Litigation Attorney Can Help

Every year, many insurance policyholders have to decide whether to hire an insurance litigation attorney. The question: take the award amount and cut their losses, or take the fight to the courts to get the compensation they deserve? Recently, a Miami federal judge ruled on a case that involved two insurance policyholders, the insurance company, and a disagreement over the award amount the insurance company wanted to pay. The insurance company claimed that the initial award (which was much higher than the revised award) offered to the plaintiffs was preliminary—the court should thus reject the plaintiffs’ stance that the initial offer should be upheld. Daniel J. Rodriguez of RRBH Law was on the case. The Case When Lazaraly Guzman and Larry Rosado claimed that their dwelling was damaged by Hurricane Irma in 2017, they couldn’t have expected how much resistance they would get from their insurance company, American Security Insurance, Co. From the start, the insureds and representatives of the insurance company could not agree on the cost of the damage from the storm, so Guzman and Rosado started the litigation process. When the parties agreed to an appraisal per the insurance policy’s instructions, the court stayed the case until …

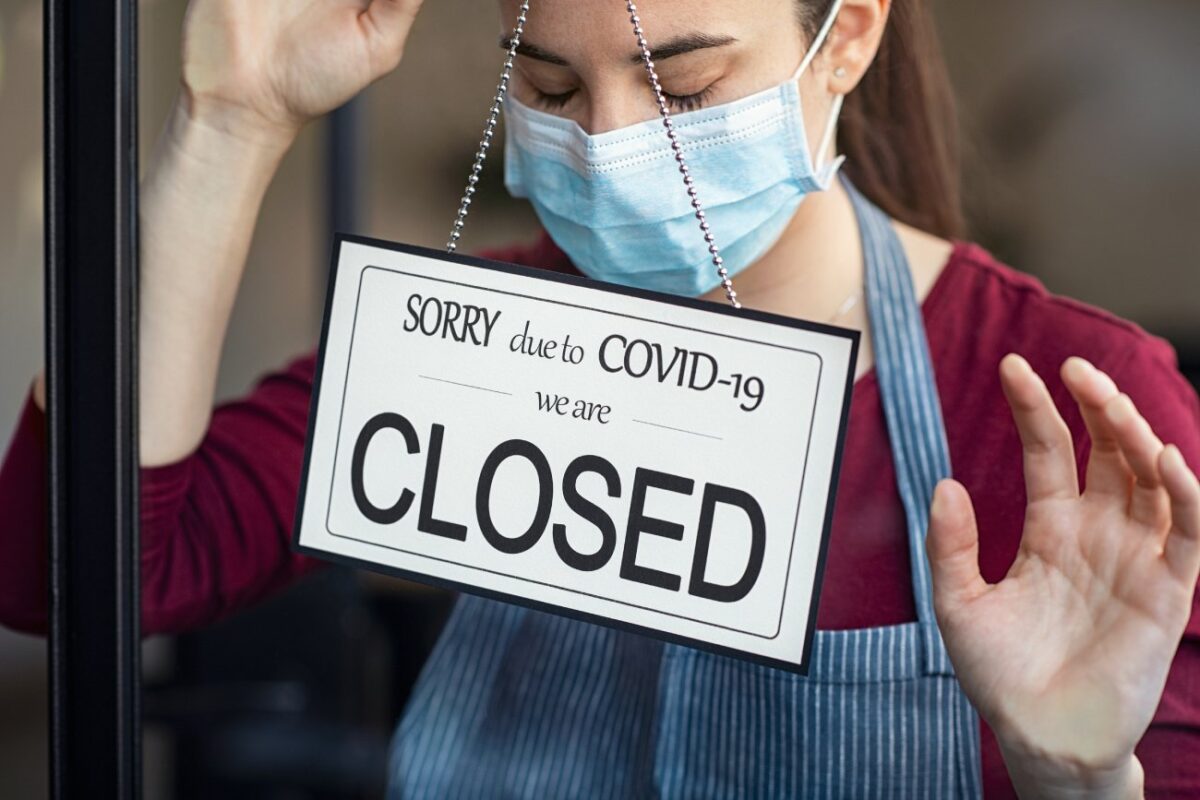

Free Business Interruption Policy Review Amid COVID-19 Shutdowns

Miami, Fla., April 2, 2020 – RRBH Law is offering free policy reviews to business interruption insurance policyholders who have experienced losses because of the coronavirus pandemic. Mandatory stay-at-home orders have shuttered businesses across the country. While necessary to protect the public health of the community, the closures have left non-essential businesses struggling. With beaches already reopening, Florida’s stay-at-home order is set to fully expire on April 30, unless Gov. Ron DeSantis extends it. However, most businesses have already experienced financial loss, and without assistance, many will be forced to close indefinitely. These current challenges that business owners face beg the question: Will business interruption insurance cover any of the losses? Insurance policies are notoriously difficult to understand, so as policyholders read their policies, they may wonder whether any of the provisions included in their policies protect them. The experienced attorneys at RRBH Law—who specialize in insurance litigation, among other areas of law—are offering their services to help policyholders understand in clear, concise language how their business interruption policies deal with the ramifications of COVID-19. The RRBH Law team is asking any business owners who have business interruption coverage to contact their office for their free policy review. To schedule …