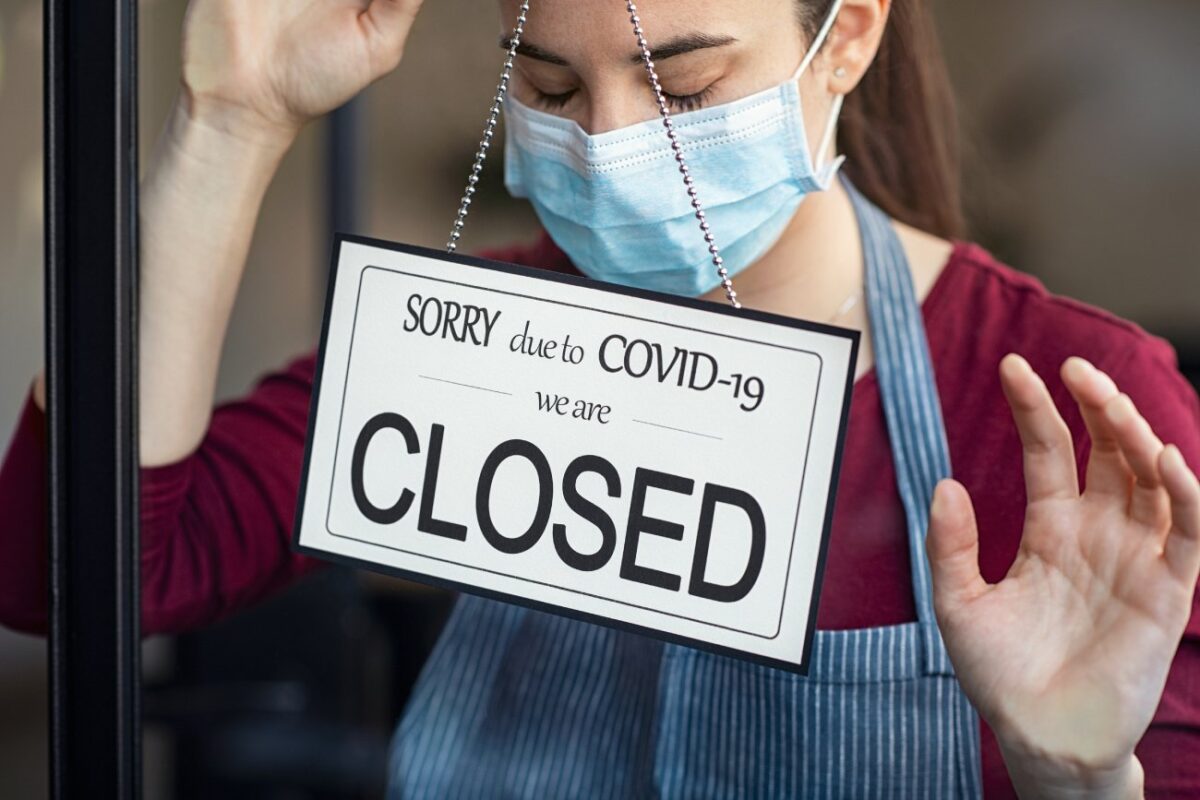

All over the country, business interruption losses are occurring due to the need for people to remain inside their homes. As a result, brick-and-mortar businesses are suffering. Here’s what you can do.

Big Changes Coming for COVID-19 Insurance Claims

COVID-19 insurance claims denied? Business interruption insurance is created for times like this. If you’ve been paying your premiums, you deserve a payout.

Hurricane Irma Claim: The Window to File Is Closing

Hurricane Irma resulted in over 838,000 residential property insurance claims. And although the storm that devastated the entire state of Florida occurred in September of 2017, it is still possible to file a claim. Damage from the hurricane has totaled nearly $50 billion. And some Florida homeowners still have not had their Hurricane Irma claims settled—roughly 7 percent, to be exact. According to this Florida statute, affected parties must file a claim with their insurance company within 3 years of the date the hurricane made landfall. Hurricane Irma made landfall in Florida on September 10, 2017, which gives policyholders until September 9, 2020 to file. Don’t let the fear of a denial stop you from submitting a Hurricane Irma claim It’s common for homeowners to feel as though their claim will be denied. Horror stories of dealing with insurance companies are always talking points for aggravated policyholders. And with exposure via social media to an even broader group of angry individuals whose claims have gone denied, the stigma grows even greater. Fear of a denial holds many policyholders back from filing in the first place. This is especially true during hurricane season, when deductibles are higher. As the holder …

Free Business Interruption Policy Review Amid COVID-19 Shutdowns

Miami, Fla., April 2, 2020 – RRBH Law is offering free policy reviews to business interruption insurance policyholders who have experienced losses because of the coronavirus pandemic. Mandatory stay-at-home orders have shuttered businesses across the country. While necessary to protect the public health of the community, the closures have left non-essential businesses struggling. With beaches already reopening, Florida’s stay-at-home order is set to fully expire on April 30, unless Gov. Ron DeSantis extends it. However, most businesses have already experienced financial loss, and without assistance, many will be forced to close indefinitely. These current challenges that business owners face beg the question: Will business interruption insurance cover any of the losses? Insurance policies are notoriously difficult to understand, so as policyholders read their policies, they may wonder whether any of the provisions included in their policies protect them. The experienced attorneys at RRBH Law—who specialize in insurance litigation, among other areas of law—are offering their services to help policyholders understand in clear, concise language how their business interruption policies deal with the ramifications of COVID-19. The RRBH Law team is asking any business owners who have business interruption coverage to contact their office for their free policy review. To schedule …