Has your homeowners insurance used bad faith tactics to avoid paying out your full settlement or deny your claim outright? You may have recourse through a lawsuit for a bad faith claim. This article offers a strategy. Do you believe your home insurer has failed to investigate your claim properly? Were you denied coverage without explanation? Have they delayed your settlement payment for an unreasonable amount of time? You may be able to file a bad faith claim against your insurer to get the compensation you deserve under your policy. Your insurance provider has a duty to deal with you in good faith. If you feel you are being treated unfairly, here are some steps you can take to increase your chances of winning your case. Preparing for a Bad Faith Claim Speak to Your Attorney From day one, you should be communicating with an attorney about your homeowners insurance claim. Your lawyer understands how the process can and should play out, so having them there to guide you can keep you from making avoidable mistakes that could jeopardize your claim. Document Everything If your claim is denied, you then need to start documenting everything you can. Get all the …

Can I Sue My Insurance Company for a Better Settlement?

Can I sue my insurance company? Get the answers to your questions. Here’s what you need to know about suing your homeowners insurance company for a fair settlement. If you have ever filed a claim with your homeowners insurance provider and felt like you should have gotten more compensation when the check came, you are not alone. As profit-driven enterprises, insurance companies have gotten really good at paying out as little as possible for claims, even when they know that their offer is not even close to what it should be. So, the question is, can you do anything about it? Can you sue them for a fair settlement? The answer? Yes, You Can Sue Your Insurance Company In some cases, litigation is your only remedy when the insurance company does not hold up its end of the bargain. You may find yourself in many different situations where you need to file a lawsuit for your property damage claim. For instance, if you believe they are acting in bad faith, have wrongfully denied your claim, or are delaying your settlement, you may need to sue. When Can I Sue My Insurance Company? Just like people are expected to follow the …

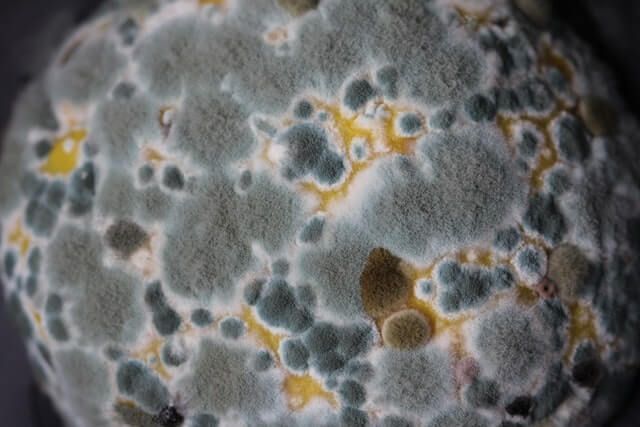

Why Mold Insurance Claims Get Denied

Words are important, especially in the legal industry. Homeowners insurance policies are often vague in their wording when it comes to mold coverage. Insurance providers sometimes deny mold insurance claims because of how a policy lays out what it covers—for the homeowners who receive a denial, that can mean they are out thousands of dollars. In a typical mold coverage case, the fate of the claim often hinges on one thing—whether the mold is a result of covered damage. Here’s what you need to know about mold insurance claims. When Does Homeowners Insurance Cover Mold? As mentioned above, in most homeowners insurance policies, mold removal is only covered when it is the result of a covered peril. Therefore, if a pipe bursts (or you experience other covered water damage) and the moisture causes mold to grow, you could file a claim for mold removal and the repair of anything permanently damaged by the mold, as well as any damage caused by the water. The primary stipulation to remember is this: if your homeowners insurance policy covers sudden, accidental water damage, you should be covered if any mold results from the water damage. Here are a few common examples of covered …

Citizens Property Insurance Corporation’s Managed Repair Program Shortchanges Homeowners

Has your home been damaged by water? If you have a homeowners insurance policy under Citizens Property Insurance Corporation’s Managed Repair Program, you might not be able to choose who does repairs. Since 2017, Citizens Property Insurance Corporation has been encouraging its policyholders towards a new program designed to handle claims for water damage stemming from sources other than storms. The reason this program is necessary, the not-for-profit government entity claims, is that non-storm water damage claims are driving up insurance rates and claims abuses by independent contractors are to blame. While it is true that some claims abuses do occur, the Managed Repair Program takes power away from policyholders. Here’s what you should know. What Is a Managed Repair Program? Check Your Homeowners Insurance Policy To summarize, managed repair programs are special homeowners insurance programs that encourage policyholders to use a contractor chosen by the insurance company to make repairs. According to the Citizens website, their program “offers valuable services to customers with eligible policies whose homes have been damaged by water not caused by weather.” The services that the company offers to new and renewal homeowner (HO-3) and dwelling property 3 (DP-3) policyholders include emergency water removal and …

These 4 Steps Could Help You Get the Most from Your Hurricane Insurance Claim

No one knows when the next big hurricane is going to hit, so it is impossible to predict when you will need to file a hurricane insurance claim. Understanding the steps that you need to take after your home or property is damaged will not only help to speed along recovery time—it can also lead to a bigger claim check. Hurricane claims are some of the most stressful to file considering the devastation that can occur. Furthermore, your insurance company is likely to be overwhelmed by claims, which can slow recovery times. In many cases, the amount people receive from their insurance is less than they deserve, so when you know how to move forward, you are less likely to be taken advantage of by the insurance company. Many of the provisions included in a typical insurance policy are confusing, and it can be difficult to tell what your policy actually covers. To prepare for a worst-case scenario in which you have to file a hurricane insurance claim, you should review your insurance policy, if possible, with the help of an attorney. Which brings us to the first step you should take after a hurricane damages your property. Call Your …

How to Prepare for a Hurricane Evacuation during COVID-19? 5 Critical Ways to Get Ready

This Atlantic hurricane season is projected to be one of the most active in recent history. So far, there have been 13 named storms, and the NOAA is calling for as many as 25 by the end of hurricane season in November. To make matters even more complicated for residents in areas like Miami, the COVID-19 pandemic could make a hurricane evacuation much more difficult. To keep yourself and your family safe in the event that an evacuation becomes necessary, we have compiled some tips to help you prepare. We are already well into hurricane season, so the sooner you start taking precautions, the better off you will be in a worst-case scenario. Preparing for Hurricanes during COVID-19 By now, you have probably already started preparing your home for the next big storm. If not, take a moment to read our recommendations here. When you are prepping your home and your plans for sheltering in place and evacuation this year, it’s important to understand that it could take longer to get supplies. Do not wait till the last minute to buy essentials like bottled water and emergency food because the stores might not have them when you need them. Give …

How Does the Roof Insurance Claim Process Work? 5 Things to Know When Filing

As most Floridians know by now, the 2020 Atlantic hurricane season is going to be a busy one. Hurricane Isaias, though only a Category 1 hurricane, caused widespread damage to homes across the east coast. One of the most common types of damage that can happen to a home during a hurricane is roof damage, which begs the question for homeowners: How does the roof insurance claim process work? When you file a claim, these five things are good to know. Making a Claim with Your Insurance After a storm damages your roof, the first thing you probably think you need to do is contact your insurance. While you do not want to procrastinate when filing a claim, it is in your best interest to consult with a property insurance attorney to make sure you are protected. Many insurance companies, to avoid losing revenue, will deny or underpay claims, sometimes in bad faith. When you have an attorney from the start of the process, you can ensure that they will take your claim seriously. Make Temporary Repairs Repairs take time, but you cannot wait to protect your home from suffering more damage from the elements. Be sure to document the …

What Is a Proof of Loss Form? Some Advice on This Critical Document

When you file a claim for a loss, your insurance provider will often require that you complete a document called a Proof of Loss form. This document details the damages that you intend to claim. It is usually one page long, though sometimes it may come with attachments. On the form, you will need to provide specific information that the insurance provider asks you to provide, including the time and date that the loss occurred, the type of loss, your policy limits, and what damages you are seeking. Some Proof of Loss forms may allow, or even require, you to provide any damage estimates to support your claim. You will need to fill out the form completely, get it notarized, and send it back to the company within the deadline your insurance company provides. Usually, you must complete it within 60 days. How to Fill Out Your Proof of Loss Form First, you will need a copy of your insurance policy. Your policy will tell you what you must include in your Proof of Loss, however, in most instances, it will require the following: Your coverage amounts at the time of the loss The date the loss occurred The cause …

Hurricane Dorian: 3 Storm Damage Claim Mistakes That Could Cost You

Hurricane Dorian made landfall in the Bahamas on Sunday, September 1 as a Category 5 hurricane. While experts have forecast that the potentially record-breaking hurricane will only graze Florida’s Atlantic coast rather than hitting it head-on, storm damage from high winds and flooding is still expected for the state, which means that many property owners will need to file an insurance claim so they can repair the damage. Homeowners and business owners need to be aware that filing an insurance claim doesn’t always guarantee full compensation. If you want to get your rightful compensation so you can repair damage to your home, avoid these three mistakes. Don’t Sign ANYTHING You Haven’t Read When filing an insurance claim, never sign anything that you have not thoroughly reviewed. Make sure that you understand the language of any paperwork that the insurance company or third parties put in front of you. Knowing what you are signing is especially important when dealing with contractors because signing a document without examining it closely could cost you the money from your insurance claim. How? While there are many respectable, conscientious contractors who want to help you repair the damage to your home or commercial property, more …

Hurricane Damage: What to Do If Dorian Batters Your Florida Home

According to CBS Miami, Tropical Storm Dorian could become a Category 3 hurricane by the time it makes landfall on the east coast of Florida on Monday. Local and state authorities are cautioning residents to prepare for hurricane damage this Labor Day, and part of that preparation means knowing how to handle an insurance claim after the storm passes. At RRBH Law in Miami, we are standing by to assist you with your claim. With over 20,000 insurance claims still open from Hurricane Michael last year, it is critical that you understand how the process works so that you don’t have to wait almost a year to get the compensation you need to rebuild. Here’s what to do if your property suffers hurricane damage from Dorian. Review Your Policy Right now, you should be reviewing your insurance policies. And yes, I do mean policies, plural. With hurricanes, you have to worry about more than one form of damage to your home because flooding is not covered under most homeowners insurance policies. You’ll have to purchase a separate flood insurance policy for that. Unfortunately, according to the South Florida Sun-Sentinel, if you don’t currently have flood insurance, you’re out of luck …

3 Critical Things Your Insurance Dispute Attorney Wants You to Know

Even though insurance companies are required to act in good faith, many attempt to take advantage of the complex and intimidating nature of the claims process to pay less than they should. Any insurance dispute attorney knows that the insurance companies are going to do what they can to reduce the claims they have to pay out. But as they say, knowledge is power. Here are a few things you should know about the insurance claims process. Adjusters Know How to Negotiate It’s pretty easy to assume that the adjuster the insurance company sends is on your side. They’ve spent a lot of money cultivating that image with commercials that imply that they are going to take care of you like family. Unfortunately, that is not always the case. Insurance adjusters are trained in negotiation. For someone unfamiliar with the claims handling process, negotiating with an adjuster can be difficult, especially since they often ask questions that can be used by the insurance company to deny your claim. Talking to an insurance dispute attorney or even letting one take over the claims process for you can save you a headache in the future. Adjusters Want to Undervalue Your Claim In …

Homeowner’s Claim Denied? An Insurance Dispute Lawyer Can Help

When you file a homeowner’s insurance claim, stress can build to intense levels. Wouldn’t it be nice if you didn’t have to worry about your insurance company denying your claim on top of everything else? Unfortunately, any insurance dispute lawyer you ask will tell you that it happens a lot. This is because insurance companies exist for one main purpose: to make as much money as possible. While having this goal doesn’t mean they will outright deny you coverage without due cause, it could mean you receive a settlement that is lower than you expected. Sometimes this happens because you and your insurance company aren’t sharing enough relevant information with each other. Fortunately, you can take these steps if you think you’ve been wrongfully denied coverage or if you think your settlement should be higher. Get Your Insurance on the Phone As soon as you receive word of a low settlement or a denial, start the process of getting in touch with your insurance. Be sure to come prepared—review your claim and come up with some ways to make your case more clear. The solution to the problem might be a simple one, such as providing more evidence of loss …

Do I Have Enough Homeowners Insurance Coverage?

Determining how much homeowners insurance coverage you need can be a difficult process, but if something should happen to your home, being as accurate as possible is definitely worth the time and effort it takes. If disaster hits, you’ll want to not only have enough to rebuild the structure of your home but also to replace belongings, to cover living expenses while you rebuild, and to protect you against liability. Here’s what you need to consider when buying homeowners insurance coverage: Factors That Will Impact How Much Coverage You Need A standard policy covers things like damage from storms, fire, and explosions. If flooding and earthquakes are common to the area you live in, you’ll need to purchase additional coverage. You’ll want to make sure that the coverage you buy is adequate to completely rebuild your home. If your coverage is based on your mortgage amount—as required by some lenders—be sure that the amount is equal to or greater than the cost to rebuild. To calculate costs, do some research on the following: The total square footage of the structure (or structures if you have multiple buildings) Local construction costs Once you have these two figures, simply multiply them for …